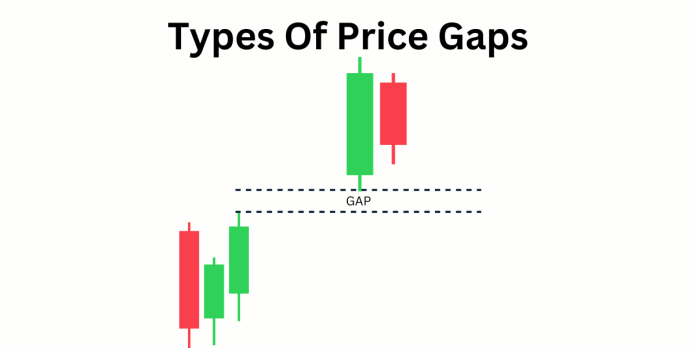

Whenever you see the markets open on a new day there might be a difference between the previous closing price and the new day’s opening price, this difference is referred to as a gap. Price charts commonly exhibit gaps, which denote periods during which no trading activity occurred within specific price intervals. These gaps are used by traders to generate strategies, trade and analysis purposes in order to increase their profitability.

In technical terms, there are two primary types of price gaps in financial markets: up gaps and down gaps. An up gap occurs when the lowest price after the market closes is higher than the highest price from the previous trading day. Up gaps are typically interpreted as bullish signals in technical analysis. Conversely, a down gap is the opposite of an up gap. It forms when the highest price after the market closes is lower than the lowest price of the previous trading day. Down gaps are generally regarded as bearish indications in technical analysis.

Read: Fundamental Analysis vs Technical Analysis

Gaps in the stock market happen when a lot of people want to buy or sell a stock, especially when the market is closed. For instance, if a company unexpectedly does really well and makes a lot of money, and this news comes out after the stock market is closed, many people will want to buy that company’s stock overnight. This creates an imbalance because there are more buyers than sellers.

So, when the stock market opens the next day, the stock’s price goes up because so many people want to buy it. If the stock price stays higher than the previous day’s highest price, it creates an up gap. Gaps like this can show that something important has changed in the way people think about a stock, or in the financial health of the company, which affects its price.

Gaps are divided into 4 categories:

- Common Gaps

- Breakaway Gaps

- Runaway Gaps

- Exhaustion Gaps

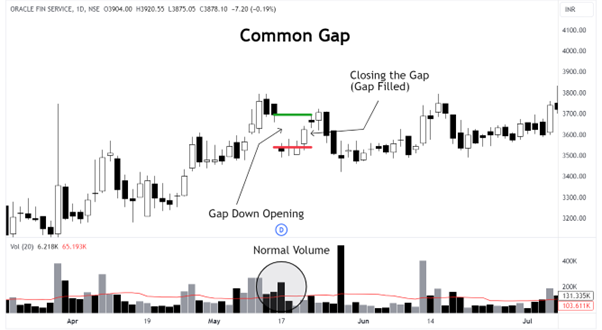

Common Gaps

These are uneventful gaps referred to as trading gaps. This might be because the stock is going under ex-dividend when trading volume is low. These types of gaps get filled quickly and price action later retraces to the same level it was, this is called closing the gap.

The below chart of Oracle Financial Services shows the perfect common gap which opened down after the dividend with normal volume and then gap filled with usual price action later on.

Common gap is a gap in the price of a stock that usually happens when the stock is trading in a narrow range or a congested area. It shows that there was not much excitement or interest in the stock at that time. These gaps often occur when there is very little trading activity, meaning not many people are buying or selling the stock. While it is good to know about these gaps, they usually don’t provide good opportunities for trading.

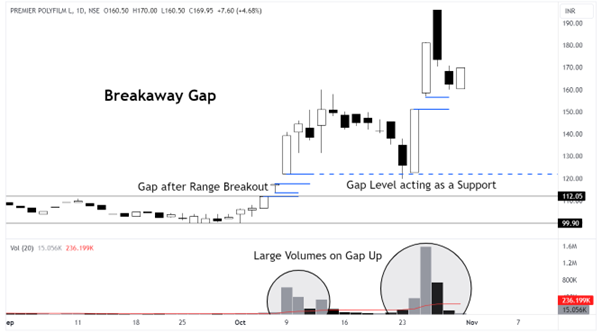

Breakaway Gaps

Breakout gap is like a thrilling event for the price action where it breaks the narrow range of trading with full thrust in which the price was stuck before. To cause a breakaway gap, it is necessary to have many buyers for up up-side gap or sellers for the down-side gap. When a breakaway gap occurs, you’ll notice a significant increase in trading volume because people who were on the wrong side of the breakout need to adjust their positions. It’s important that this surge in volume happens after the gap appears because it suggests the new market direction is more likely to continue. The level where the breakout occurred now becomes the new support or resistance. Don’t assume the gap will be filled soon, in this case, it may take a long to close the gap.

In the above chart of Premier Polyfilm breakaway gap each and every thing about the gap is shown as mentioned earlier.

Price gaps that occur alongside well-defined chart patterns, like an ascending triangle with a strong breakout gap to the upside, often provide more reliable trading opportunities compared to gaps that happen without such clear patterns.

Runaway Gaps

Runaway gaps are gaps in a stock’s price chart that occur due to sudden and strong interest from traders. When there’s a runaway gap upwards, it means that traders who missed the initial uptrend suddenly start buying the stock, causing its price to jump above the previous day’s closing price. This type of gap often reflects a sense of urgency among traders.

Runaway gaps can also happen during downtrends when traders are selling the stock, and there are few buyers, leading to a gap down in the price. These gaps can sometimes give us clues about the duration of a trend. In rare cases, the futures market may experience runaway gaps due to trading limits set by exchanges, which can be both good and bad for traders.

Below chart of Reliance Industries shows the example of Runaway Gap.

Exhaustion Gaps

Exhaustion gaps are like warning signs that show up when a strong trend in the stock market is about to end. They stand out because they have a big gap between the previous day’s closing price and the new day’s opening price, and they come with a lot of trading activity. When these gaps happen after a long downward trend, it can be a sign of panic among investors, leading to a rush to sell their holdings.

In contrast, during an upward trend, people get overly excited and buy a lot, causing the prices to jump with high trading volumes. However, this enthusiasm doesn’t last, and profit-taking kicks in. As a result, the trend reverses, and prices drop, marking a significant change in market direction.

The above chart of ICICI Bank shows an example of an exhaustion gap.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.