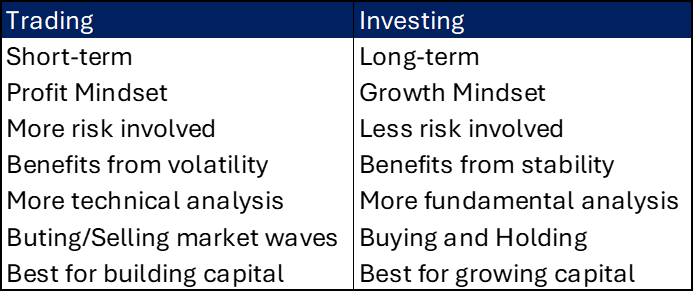

In the vast landscape of finance, two prominent players take center stage: trading and investing. While these terms are often used interchangeably, they represent distinct strategies with unique objectives, timelines, and mindsets. Both methods aim to generate profits from the fluctuations of stock prices, but they differ significantly in their strategies, risk profiles, and potential rewards.

Intraday Trading: A High-Risk, High-Reward Endeavor

Intraday trading involves buying and selling stocks within the same trading day, aiming to capitalise on short-term price movements. This approach demands constant monitoring of market trends, quick decision-making, and a strong tolerance for risk. Intraday traders often employ technical analysis, studying charts and patterns to identify potential entry and exit points.

Pros of Intraday Trading

- Potential for High Returns: Skilled intraday traders can generate substantial profits by exploiting short-term market fluctuations.

- Flexibility and Control: Intraday traders have complete control over their trading decisions and can adjust their strategies based on market conditions.

Cons of Intraday Trading

- High Risk of Losses: Intraday trading is inherently risky, with the potential for significant losses due to rapid price movements.

- Demanding Lifestyle: Intraday trading requires intense focus and commitment, often resulting in long hours of screen time and emotional stress.

- High Transaction Costs: Frequent trading can lead to substantial transaction costs, which can erode profits.

Long-Term Investing: A Patient, Low-Risk Approach

Long-term investing, on the other hand, focuses on holding stocks for extended periods, typically years or even decades. This approach is based on the belief that stock prices generally trend upward over the long term, driven by company growth, economic trends, and overall market performance.

Pros of Long-Term Investing

- Lower risk and volatility: Long-term investing is generally considered less risky than day trading, as it allows time for market fluctuations to even out.

- Potential for compounding returns: Long-term investors can benefit from the power of compounding, where returns are earned on both initial investments and accumulated profits.

- Reduced stress and emotional involvement: Long-term investing requires less active monitoring and decision-making, leading to lower stress levels.

Cons of Long-Term Investing:

- Delayed Returns: Long-term investors may experience limited returns in the short term and need patience to reap the full benefits.

- Less Control Over Returns: Long-term investors are subject to market fluctuations and may experience periods of negative returns.

- Requires Larger Capital Investment: Long-term investing often requires larger upfront capital compared to day trading.

The Duel: Investing vs. Trading – Who Wins the Battle?

The online consensus leans towards investors building diversified portfolios, and weathering market storms for extended returns. They buy and hold assets, seeking larger returns over time. On the flip side, traders ride the market rollercoaster, exploiting both rising and falling markets for quick returns based on short-term moves.

The Misunderstood Art of Trading Analysis

A prevalent misconception claims that traders lack analytical rigour compared to their investor counterparts. However, a deeper dive reveals that successful traders engage in specialized analyses, seeking pricing anomalies in markets. From merger arbitrage to statistical arbitrage, traders leverage their expertise to navigate complex financial landscapes.

The Social Good of Trading

Contrary to popular belief, short-term traders contribute to market efficiency. By swiftly reacting to mispricings and market imbalances, they ensure fair prices for all investors. This mechanism, akin to the laws of supply and demand, plays a vital role in maintaining economic equilibrium.

Trading’s Gambit in the Financial Arena

While trading offers exposure to unique strategies and analytical approaches, it’s not without its pitfalls. Transaction costs, often underestimated, can erode returns significantly. Moreover, the allure of being taxed at a lower rate as a long-term investor presents a compelling argument for buy-and-hold enthusiasts.

Buffett’s Trading Stint

Addressing the Buffett quote head-on, it becomes evident that labelling a trader as an investor is not only accurate but also applies to the Oracle of Omaha himself. Buffett, known for his long-term approach, also engages in trading activities, delving into derivatives, merger arbitrage, and special situations trades.

Read: Investment Titans: Bill Ackman vs Carl Icahn vs Warren Buffett

Trading is the swift dance with market fluctuations, exploiting short-term moves. Investing, a patient journey, involves nurturing assets for long-term growth.

Wisdom lies in understanding the rhythm of both: trading for agility and investing for enduring prosperity—a harmonious balance in the symphony of financial success.

The Symbiotic Dance of Trading and Investing

In the intricate tapestry of finance, the distinction between trading and investing may be more blurred than acknowledged. Both contribute to market dynamics, each with its unique advantages and drawbacks. Whether you’re a trader navigating market nuances or an investor building a fortress of long-term gains, the financial landscape welcomes both, creating harmony and freedom in the pursuit of wealth.