In the thrilling world of investments, where market tides are as unpredictable as a poker game, investors become strategic gamblers. They crave more than luck; they seek the ace up their sleeves. Enter the Information Ratio (IR), the hidden gem in a sea of financial metrics. It’s not just a number; it’s the secret sauce, revealing the wizardry behind savvy investment moves. Think of it as the magic wand that separates the wizards from the apprentices.

Deciphering the IR: A Symphony of Skill and Consistency

The Spotlight on IR:

In the intricate dance of returns and risks, the Information Ratio emerges as the maestro. This risk-adjusted performance measure unveils a portfolio’s ability to soar above benchmarks while gracefully managing the tempest of market volatility.

Formulaic Secrets:

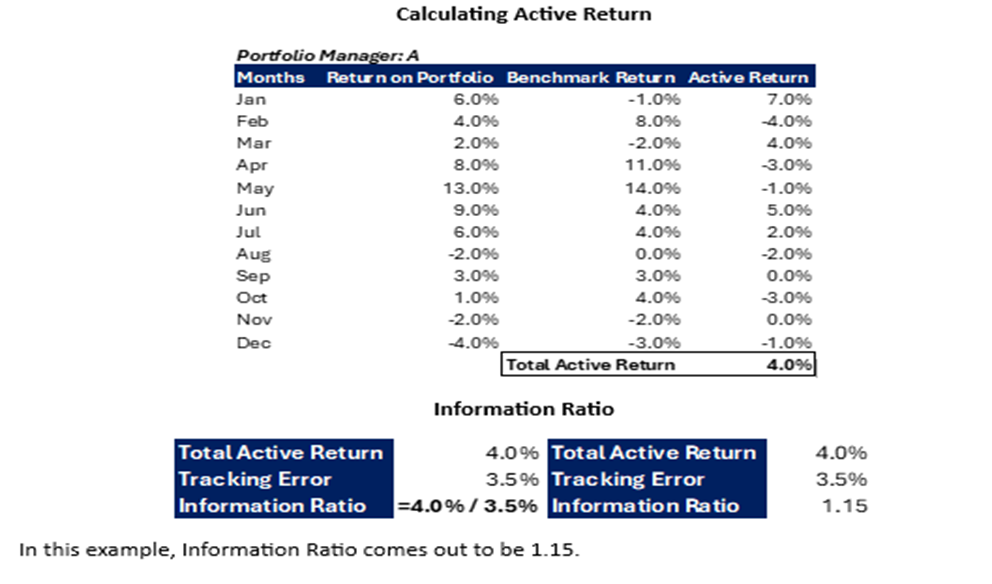

The IR, our mysterious protagonist, reveals itself through a simple yet powerful formula. It’s the active return divided by the tracking error. Think of it as the portfolio’s performance ballet, where active return waltzes with tracking error’s volatility.

Information Ratio= (Portfolio Return – Benchmark Return)/Tracking Error

Example:

Interpreting IR Values

Positive Vibes:

A positive IR echoes triumph – the portfolio manager consistently outshines the benchmark, a maestro of returns. On the flip side, a negative IR signals an off-note, a hint that the portfolio is trailing behind the market’s rhythm.

Magic Number 1.0:

As we disclose the curtain, the magic number is 1.0. An IR above this threshold signals not just success, but virtuosity. It’s the sweet spot where excess returns and prudent risk management waltz hand in hand.

Comparative Analysis: A Duel of Portfolio Managers

Arena of Excellence:

Let’s dive into a hypothetical scenario involving Fund Manager A and Fund Manager B.

Fund Manager A:

Annualized Return: 13%

Tracking Error: 8%

Fund Manager B:

Annualized Return: 8%

Tracking Error: 4.5%

Read: A Proactive Approach to Portfolio Management

Benchmark Index:

Annualized Return: -1.5%

Fund Manager A:

IR of 1.81 implies a commendable performance, showcasing a 13% return while managing an 8% tracking error. A positive IR suggests consistent outperformance relative to the benchmark.

Fund Manager B:

Surprisingly, with a lower annualized return of 8%, Fund Manager B’s IR of 2.11 steals the spotlight. This higher ratio is a result of not just returns but a meticulous 4.5% tracking error, signalling a portfolio that dances with less risk and greater consistency.

The information ratio serves as a valuable tool for evaluating the risk-adjusted performance of investment portfolios or strategies. By assessing the consistency and effectiveness of excess returns relative to a benchmark, investors can make informed decisions about their investment choices. While the IR should not be considered the sole determinant of investment decisions, it provides a valuable perspective on the skill and risk management capabilities of portfolio managers.

Know More: