In the world of options trading, where strategies abound, the box spread emerges as a distinctive and intriguing play. Known for its risk-free appeal, this strategy captivates seasoned traders and investors alike.

Understanding the Box Spread

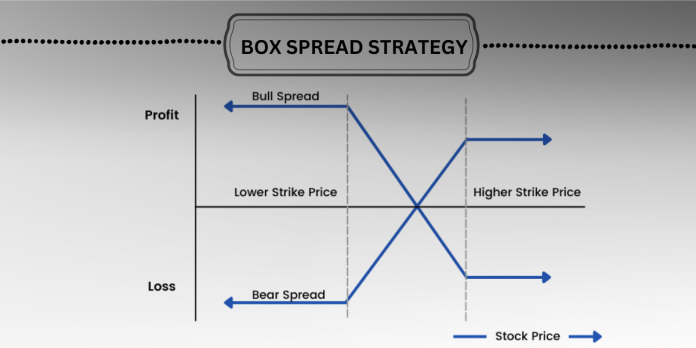

The box spread, a four-legged options strategy involves the combination of a bull call spread and a bear put spread with the same strike prices. This creates a box-like structure, hence the name. The key feature that makes the box spread intriguing is its potential for a risk-free profit when certain conditions are met.

The box spread strategy can be viewed as a fusion of synthetic long and synthetic short forward positions. In the synthetic long forward, an investor takes on the right and obligation to buy, achieved by combining a long call and a short put with identical strike prices and expiration dates.

Conversely, the synthetic short forward involves the right and obligation to sell, realized through a long put and a short call with matching strike prices and expiration dates.

Deconstructing the Components

- Bull Call Spread:

- Involves buying a lower strike call and simultaneously selling a higher strike call.

- Capitalizes on a bullish outlook, limiting both potential gains and losses.

- Bear Put Spread:

- Encompasses buying a higher strike put and selling a lower strike put.

- Capitalizes on a bearish outlook, also limiting potential gains and losses.

The Risk-Free Conundrum

The allure of the box spread lies in its unique ability to create a risk-free scenario under specific circumstances. If the total premium paid for the bull call spread is less than the total premium received for the bear put spread, a risk-free profit zone emerges. Traders can exploit market inefficiencies to secure this advantageous position.

Example: BANKNIFTY – Options Chain

| CALL | Strike | PUT |

| LTP | LTP | |

| 1020 | 46800 | 262.2 |

| 764 | 47200 | 390.3 |

| Long Forward | |||

| X: 46,800 | Long Call | Short Put | Net |

| Premium | -1020 | 262.2 | -757.8 |

| Short Forward | |||

| X: 47,200 | Long Put | Short Call | Net |

| Premium | -390.3 | 764 | 373.7 |

Read: Understand Iron Condor Options Strategy

Profit

|

(Lot Size 15) |

||

| Investment | -384.1 | -5761.5 |

| Profit | 400 | 6000 |

| Net Profit | 15.9 | 238.5 |

| Earning Spread | 0.04139547 | (17 Days) |

| Annualised | 1.389016235 |

Transaction costs, bid-ask spreads, and market fluctuations can impact the feasibility of achieving a risk-free profit.

Advantages of Box Spreads:

- Risk-free: Box spreads are considered neutral options strategies, meaning they have no delta or directional bias. Therefore, the profit or loss is primarily determined by the time decay (theta) of the options.

- Capital-efficient: Compared to outright options purchases, box spreads require less upfront capital investment.

- Limited downside risk: The maximum potential loss is limited to the difference between the premiums paid and received.

- Flexibility: Box spreads can be used to create synthetic forward positions or for pure arbitrage opportunities.

Disadvantages of Box Spreads:

- Limited profit potential: The maximum profit is capped at the spread between the strike prices of the options, which can be relatively small.

- Requires market timing: Exploiting arbitrage opportunities requires identifying price discrepancies and executing the trade at the right time.

- Commissions and fees: Transaction costs can eat into the potential profits, especially for smaller trades.

Ideal Scenarios

The box spread thrives in specific market conditions, such as:

- Low volatility, reducing the impact of bid-ask spreads.

- Interest rate differentials that contribute to discrepancies in call and put premiums.

Read: An Introduction to Call and Put Options

The box spread, with its chess-like intricacies, offers a fascinating glimpse into the nuanced world of options trading. Traders seeking to exploit market inefficiencies and capitalize on specific conditions may find the box spread a valuable addition to their strategic arsenal.