Certainly! The correction is a term that you’ve likely heard from various stock market participants around you. Regarding stock market fluctuations, two significant terms often discussed by investors and analysts are “time-wise correction” and “price-wise correction.” Both these concepts play crucial roles in understanding market movements and determining investment strategies. Each type of correction reflects distinct characteristics that can influence market sentiment, investor behavior, and overall trading patterns. In this article, we are going to explore both the term.

Time-wise Correction

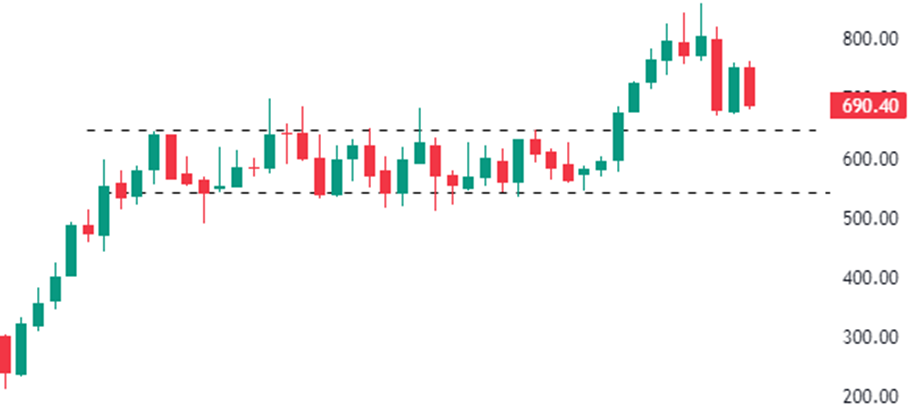

Time-wise correction, also known as a sideways or horizontal correction, occurs when the stock or market index moves within a range over a prolonged period without displaying significant upward or downward momentum. During this phase, the price fluctuates within a defined range, creating a horizontal pattern on the price chart. This consolidation phase typically reflects a period of market indecision or equilibrium between buyers and sellers.

In a time-wise correction, investors might witness lower trading volumes and reduced volatility compared to other market phases. This consolidation period can last for weeks, months, or even longer, with the price oscillating within a certain band without a clear trend in either direction.

Reasons behind time-wise corrections can vary. It might be a result of market fatigue after a prolonged bullish or bearish trend, uncertainty due to geopolitical events or economic indicators, or simply a pause in market activity as traders reassess their positions.

The chart below shows how the stock surged from approximately Rs 200 to Rs 650. Following that upward movement, instead of a price correction, it underwent a time-wise correction. The stock price stagnated, trading within a narrow range of roughly Rs 100 to Rs 120 before breaking out of that range.

Price-wise Correction

On the other hand, a price-wise correction, often referred to as a vertical or amplitude correction, signifies a significant movement in the price of a stock or market index, either upwards or downwards, after a sustained trend. These corrections can happen swiftly and are characterized by sharp movements in price, leading to a rapid change in the overall market sentiment.

Price-wise corrections are driven by various factors such as sudden changes in economic indicators, unexpected geopolitical events, corporate earnings reports, or shifts in investor sentiment. These corrections can trigger panic selling or buying, leading to rapid price movements that create new support or resistance levels on the price chart.

Remember the COVID-19 fallout when the overall market sentiment shifted from bullish to bearish, resulting in a significant drop in stocks and indices? That was a price-wise correction. Take a look at the chart below to see how the price underwent a significant correction quickly.

Distinguishing Between the Two

Differentiating between time-wise and price-wise corrections is crucial for investors in devising their trading strategies. Time-wise corrections may present opportunities for the accumulation or distribution of stocks as the market moves sideways, while price-wise corrections might offer quick buying or selling opportunities for traders looking to benefit from the sudden price movements.

Read: Master Candlestick Patterns: A Guide to Enhance Your Trading Strategies

Strategies for Dealing with Corrections

For investors navigating through corrections, a diversified portfolio and a long-term perspective can help weather market fluctuations. Researching fundamentally strong companies or assets and utilizing technical analysis tools can aid in identifying potential entry or exit points during both time-wise and price-wise corrections. It’s always important to remember not to time the market when building your position in stocks or indices. Wait until there’s a display of strength and indications of a reversal on the chart. Relying solely on expectations won’t necessarily lead to earning money in the stock market and building wealth.

It’s important to note that corrections are integral parts of market cycles, and they do not necessarily signify the beginning of a bear market or the end of a bullish trend. They can create opportunities for investors to enter or exit positions at more favourable prices.

Conclusion

In the dynamic world of stock markets, understanding the difference between time-wise and price-wise corrections empowers investors to make informed decisions. While time-wise corrections represent consolidation and a lack of clear directional movement, price-wise corrections signify sharp and sudden changes in price. Both types of corrections offer unique opportunities and challenges, and investors who comprehend these dynamics can adapt their strategies to navigate the market’s ups and downs more effectively.