Gold, the shimmering metal that has captivated humanity for centuries, holds a unique position in the world of finance. Its lustre extends beyond its aesthetic appeal, as it plays a significant role in investment portfolios. While its value fluctuates over time, gold has historically served as a hedge against inflation, a safe haven during economic turmoil, and a diversifying asset in a well-structured portfolio.

Diversification: A Balancing Act in the Investment

In the realm of investments, diversification is akin to spreading your wings to minimize risk. By allocating your assets across various asset classes, you reduce your reliance on the performance of any single asset. Just like a single tree may succumb to a storm, a diversified portfolio can weather the ups and downs of the market with greater resilience.

Gold, with its distinct characteristics, can serve as an effective diversifier in your portfolio. Its price movements often exhibit a low correlation to those of traditional asset classes like stocks and bonds. This means that when stocks and bonds are falling, gold may hold its value or even appreciate, providing a much-needed counterbalance to your portfolio’s risk profile.

Inflation: A Silent Erosion of Purchasing Power

Inflation, the persistent rise in the general price level of goods and services, silently chips away at the purchasing power of your money. Over time, inflation erodes the value of your savings, making it difficult to maintain your standard of living.

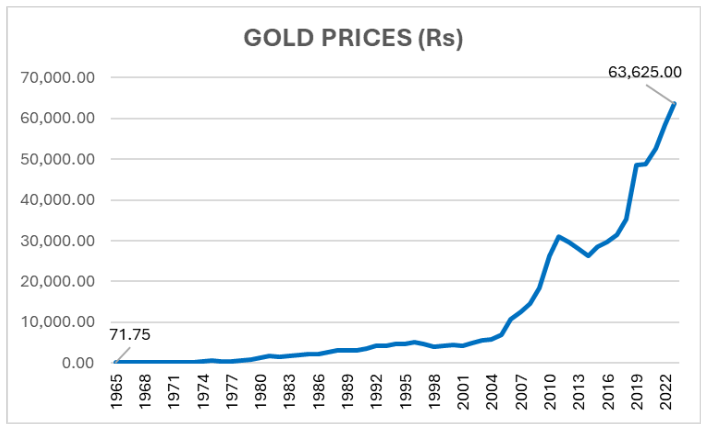

Gold, with its long history of retaining value over extended periods, can act as a hedge against inflation. While its price can fluctuate in the short term, over the long run, gold has tended to maintain its purchasing power, protecting your wealth from the ravages of inflation.

Economic Uncertainty: Seeking Safe Harbor in Turbulent Times

Economic downturns and periods of market volatility can send shockwaves through financial markets, causing investors to seek refuge in assets perceived as safe havens. Gold, with its reputation for stability and resilience, often emerges as a preferred choice during such times of uncertainty.

When stock markets plummet and investors panic, gold often holds its value or even appreciates. This inverse relationship between gold and stocks makes gold an attractive asset to hold during periods of economic turmoil, providing a sense of security amidst the chaos.

Investing in Gold

To incorporate gold into your investment portfolio, you have a variety of options to consider:

- Physical Gold: Purchasing physical gold in the form of bullion bars or coins offers the tangible satisfaction of owning the precious metal. However, it comes with storage and security considerations.

- Gold Exchange-Traded Funds (ETFs): Gold ETFs, traded on stock exchanges, offer a more convenient and cost-effective way to invest in gold without the physical storage hassles.

- Gold Mutual Funds: Gold mutual funds, managed by professional fund managers, provide exposure to gold along with diversification benefits.

Know: The Power Of Sovereign Gold Bonds

Determining Your Gold Allocation

The ideal allocation of gold in your portfolio depends on your individual circumstances, risk tolerance, and investment goals. A financial advisor can help you determine an appropriate allocation that aligns with your overall investment strategy.

As a general rule, gold allocations tend to range from 5% to 10% of an overall portfolio. However, some investors may choose to hold higher or lower percentages based on their specific circumstances and beliefs about gold’s future performance.

Conclusion

Gold, with its rich history and unique characteristics, continues to play a significant role in investment portfolios. Its ability to hedge against inflation, provide a safe haven during turbulent times, and diversify a portfolio makes it an attractive asset for investors seeking stability and resilience in their investment strategies.