Black Swan Event will occur once in a while but it pops up anytime, anywhere in the life. As the swan are white in color there are rare chances that someone will spot a black color swan in the sky. Replicating the same in the context of the stock market it is an event which is an unpredictable event where the probability of occurrence is very less but in case of occurrence it has a severe impact on the economy. The event doesn’t show any hint before entering into the situation it just hit the overall world with its surprise and huge damaging effect on the economy.

This event is introduced by Nassim Nicholas Taleb in his book. Taleb wrote about the idea of a black swan event in a 2007 book before the 2008 financial crisis. The following are the characteristics of the black swan event:

- Is so rare that even the possibility that it might occur is unknown

- Has a catastrophic impact when it does occur

- Is explained in hindsight as if it were actually predictable

Taleb’s main point is that regular tools we use to predict things, like looking at past data and using statistics, don’t work for extremely rare events, which he calls black swans. These rare events are so unusual that we can’t rely on history to predict them, and trying to do so can actually make us more vulnerable to their impact. Another thing to note is that when these rare events happen, people often try to figure out why they occurred and how we could have seen them coming. But this looking back doesn’t really help us prepare for future black swan events because they can be completely different and unexpected, like a financial crisis or a sudden war.

Black Swan Event in the Stock Market

A black swan event in the stock market refers to an extremely rare and severe market crash, typically surpassing six standard deviations, which makes it highly improbable based on statistical probabilities.

Black Swan Events in Indian Stock Markets

The global COVID-19 pandemic, responsible for nearly 6,931,663 deaths worldwide, is not the sole recent occurrence that has significantly impacted stock markets around the world. In the past, there have been other unforeseen events that led to financial market downturns, affecting India and various other regions. In the previous three decades, there have been a few more significant “Black Swan” events that caused the Sensex to jump in deep red.

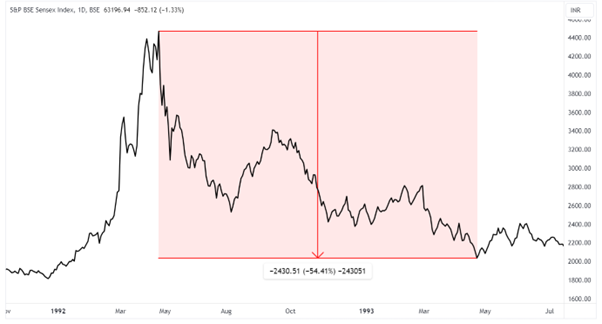

The Harshad Mehta Scam (1992)

The Harshad Mehta scam of 1992, involving a massive Rs 4,500 crore stock manipulation scheme, had a devastating effect. During the same year, the BSE Sensex witnessed a sharp decline of 45%, and it took a year and a half for it to bounce back.

Asian Currency Crisis (1997)

The Asian currency crisis, which began in 1997, caused financial upheaval across East Asia, affecting nations like South Korea, China, and Thailand. The Sensex saw a significant 38% drop over 15 months, but it managed to recover in eight months.

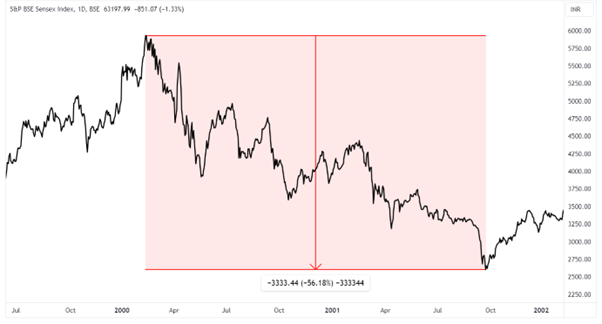

The Dot-Com Bubble in The United States (2000)

In 2000, the burst of the dot-com tech bubble had a global impact. The S&P BSE Sensex experienced a substantial 57% drop from its peak in just 14 months, and it took more than two years, the longest recovery period on record (26 months), for the markets to regain stability.

2007–2008 Financial Crisis

The global financial crisis of 2008, often compared to the Great Depression, saw the Dow Jones Industrial Average tumbling 20% in a single month, making it one of the most significant monthly declines in the history of American stock markets. The ripple effects of this crisis were felt worldwide, and the S&P BSE Sensex in India also saw a decline of 27% during the same period, dropping from 13,418 points to 9,748 points.

Read: Financial Bubbles in the World

Fighting with Black Swan Event

Strategy 1: When a black swan event seems probable, consider adding put options to your portfolio to limit potential losses. If the black swan turns out positively, you’ll still benefit after covering the option cost; if it’s negative, the put option can provide a safety net.

Strategy 2: Maintain an allocation plan that automatically adjusts your asset mix based on factors like valuations and interest rates. This ensures disciplined investing and reduces the risk of holding overpriced assets. Since black swans tend to occur periodically, it’s wise to be cautious and prepared for the unexpected.