In the grand symphony of global economics, the interplay between interest rates, inflation, and exchange rates orchestrates the intricate movements that shape the fortunes of nations and individuals alike.

Interest Rates and Foreign Exchange

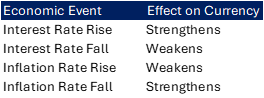

The dance between interest rates and foreign exchange rates is a delicate ballet in the global economic arena. When the interest rates of a foreign country surge relative to the home country, it sets off a chain reaction, weakening the home currency. This relationship hinges on real interest rates, excluding the impact of inflation.

Example: Interest Rate Influence

Consider a scenario where the risk-free interest rate in the U.S. stands at 5%, while in the U.K. it’s a robust 10%. Assuming an initial exchange rate of $1.5/£1, if the U.K. interest rate climbs to 12%, the British pound is likely to strengthen against the dollar.

The Role of Inflation

Inflation, the rise in the general price level of goods and services, introduces another layer to the currency dynamics. If the inflation rate in a foreign country surpasses that of the home country, the foreign currency tends to devalue relative to the home currency. This manifests as an alteration in the cost of goods and exchange rates.

Example: Inflation’s Influence

Imagine silver priced at $1,500/lb in the U.S. and £1,000/lb in the U.K. Initially, it takes $1.5 to buy £1. Now, assume the U.K.’s inflation is 10%, while the U.S. experiences 0% inflation. At year-end, silver in the U.K. costs £1,100/lb due to inflation, weakening the British pound against the dollar.

Calculation: If the exchange rate initially is $1.5/£1 and, due to inflation, it becomes $1.36/£1, a 9.33% depreciation has occurred.

Read: All you Need to Know about Inflation

Advanced Explanation: Arbitrage Opportunities

In the presence of differing inflation rates, arbitrage opportunities emerge. Consider the same scenario with the U.K.’s 10% inflation and the U.S.’s 0% inflation. If the exchange rate remains unchanged, individuals could profitably exploit the inflation gap by buying silver in the U.S., selling it in the U.K., and converting the proceeds back to dollars.

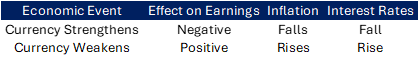

Corporate Realities: Exchange Rates and Earnings

Companies engaged in international trade face the challenge of currency risk. Fluctuations in exchange rates directly impact earnings. A weaker home currency enhances earnings when converting foreign revenues, while a stronger currency diminishes earnings.

Example: Corporate Currency Risk

Take Coca-Cola selling soda in the U.K. for £1 per 2-litre bottle with an initial exchange rate of $1.50/£1. If the dollar weakens, say to $1.60/£1, Coca-Cola’s earnings rise when converting pounds to dollars.

Calculation: If the exchange rate initially is $1.50/£1 and weakens to $1.60/£1, Coca-Cola’s earnings increase, assuming all else remains equal.

Exchange Rates, Interest Rates, and Inflation: A Triangular Nexus

Widely Held Principle

A nuanced relationship exists between exchange rates, interest rates, and inflation. A weak dollar may lead to imported goods becoming pricier, contributing to higher inflation, and subsequently prompting an increase in interest rates. Conversely, a strong dollar can lower inflation by reducing the cost of imported goods, leading to lower interest rates.

The Zero Bound Dilemma: Zero and Negative Interest Rates

Interest rates are constrained by the zero bound, posing challenges during economic contractions. With deflation, a scenario where prices fall, debts become burdensome, and the debt-deflation hypothesis takes effect. Japan’s experience with prolonged deflation in the 1990s underscores the limitations of conventional monetary policy.

Solutions: Beyond Zero Interest Rates

When interest rates are already at zero, unconventional monetary policies like quantitative easing come into play. These measures aim to infuse cash into the economy or may involve charging banks for holding excess reserves.

Striving for Stability: Inflation as the Economic Grease

Amidst the complexities of inflation and deflation, a call for moderation arises. Moderate inflation, around 1-2% per year, is considered the economic grease, facilitating stability. This modest inflation ensures a balance between rising costs and the purchasing power of individuals.

In the intricate world of global economics, understanding the interconnected forces of interest rates, inflation, and exchange rates is paramount. Navigating this complex web requires a careful dance, where policymakers, businesses, and individuals must adapt their strategies to the ever-evolving dynamics of the global economy.