Pricing strategies are a fundamental component of any business’s marketing approach. Companies use a variety of tactics to encourage consumers to make purchases, and one such strategy is the “Decoy Effect.” This psychological pricing phenomenon exploits human decision-making processes to influence consumer choices and nudge them toward spending more.

In the realm of marketing, price is a delicate instrument, skillfully wielded by corporations to maximize their revenue. Among the many pricing strategies employed, the “Decoy Effect” stands out as a cunning tactic, strategically designed to nudge consumers toward choices that lead to increased spending. In the financial world, this effect plays a crucial role, impacting the consumer behaviour and influencing investment decisions.

In this article, we will explore the Decoy Effect and how corporations use it to their advantage.

Understanding the Decoy Effect

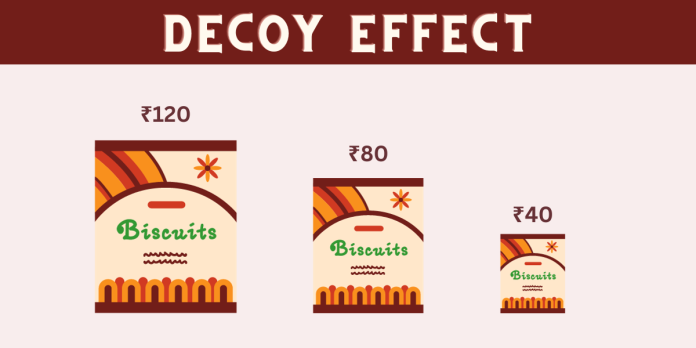

The Decoy Effect, also known as the asymmetric dominance effect, occurs when a third option, the “decoy,” is introduced to manipulate the decision-making process. This decoy is not intended to sell but rather to make one of the other options more appealing. The ultimate goal is to guide consumers away from a less profitable choice and steer them towards a more lucrative one, often the more expensive option.

The Decoy Effect exploits the psychology of choice overload, where consumers confronted with too many alternatives tend to simplify their decision-making process by focusing on a few key criteria, such as price and quantity. Corporations manipulate these critical choice attributes to subtly direct consumers toward options that maximize profits.

Imagine you’re at a movie theatre, deciding between a small and a large popcorn. The small popcorn costs $5, and the large popcorn costs $8. Most people would opt for the smaller size. However, when a medium-sized popcorn at $7 is introduced, it becomes the decoy. The medium size makes the large option seem like a better deal, and many consumers will choose the large popcorn, thinking they are getting a bargain compared to the medium size.

In the financial landscape, similar tactics come into play. Investors often face numerous investment options, and the Decoy Effect subtly nudges them toward certain choices by manipulating their perceived value.

-

Corporations Exploiting the Decoy Effect

Many corporations, from airlines to tech companies, use the Decoy Effect to increase their profits. Let’s delve into some real-world examples of how this psychological pricing tactic is deployed:

- Subscription Plans: Streaming platforms like Netflix employ the Decoy Effect to influence subscription choices. They offer three plans: Basic, Standard, and Premium. The Basic plan is inexpensive but has limitations. The Premium plan, on the other hand, offers more features at a higher price. The Standard plan, positioned as the decoy, bridges the gap between Basic and Premium. Customers often choose the Premium plan, thinking it’s a better value compared to the Standard option.

- Airline Tickets: Airlines often present travellers with multiple fare options. By introducing a decoy fare that offers little or no additional value but is priced slightly higher, they encourage passengers to choose the more expensive options, boosting revenue.

- Smartphones: Tech companies release multiple versions of a product, where the most expensive one is the primary target. The intermediate version, often with only minor upgrades, serves as the decoy. Consumers, seeing the large price gap between the base model and the premium version, are inclined to spend more.

-

Decoy Pricing in the Market

Decoy pricing is pervasive in the financial world, with examples spanning from investment products to subscription services.

For instance, subscription pricing for financial publications often incorporates decoy elements. An offering with a digital-only subscription at a specific cost, when paired with a digital+print option at the same price, can influence subscribers to opt for the more comprehensive choice. In this scenario, the digital-only option becomes the decoy, steering consumers toward the combined digital and print subscription.

Not all decoys are overt; in fact, subtlety can make them even more effective. Consider the pricing strategy at a juice bar where a small-sized drink costs USD 6.10, a medium USD 7.10, and a large USD 7.50. At first glance, it might seem logical to choose the medium, given its slightly better value compared to the small. However, the pricing of the medium option, priced at USD 1 more than the small but just 40 cents less than the large, asymmetrically dominates the choices. As a result, consumers are often nudged toward selecting the largest, seemingly best-value drink.

In the financial world, the Decoy Effect can manifest in various forms, from investment options to pricing structures for financial products and services. Investors must be vigilant, ensuring their decisions are not swayed by subtle manipulations designed to promote more expensive or profitable choices.

-

Consumer Empowerment

Understanding the Decoy Effect is crucial for consumers to make informed decisions. Here are a few tips to avoid falling victim to this pricing strategy:

- Compare Options: Always compare the value of each option, rather than relying solely on the price. Is the additional cost justified by the added benefits?

- Consider Your Needs: Assess your actual needs and preferences. Don’t let the decoy option sway you into making a decision that doesn’t align with your requirements.

- Research and Awareness: Be aware that companies employ various pricing strategies, including the Decoy Effect. Conduct research and read product reviews before making a purchase.

Conclusion

The Decoy Effect, rooted in psychology, has become a powerful pricing strategy used by corporations to influence consumer choices and encourage spending. While it can be viewed as a manipulation of consumer decision-making, it also underscores the importance of informed choices. By understanding the nuances of this strategy, consumers and investors can make more informed decisions, ensuring that their choices align with their needs and preferences rather than falling prey to clever pricing tactics. In a world filled with complex financial options, awareness and empowerment are essential to navigate the market effectively and make rational, informed decisions.

Disclaimer: This blog has been written exclusively for educational purposes. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.