Public Provident Fund (PPF) and Equity Linked Savings Scheme (ELSS) often stand out as popular options in India when planning your investments, especially for tax-saving purposes. Both offer unique advantages and cater to different investor preferences and risk appetites. Let’s delve deeper into each option to help you make an informed decision.

PPF (Public Provident Fund)

PPF is a government-backed savings scheme with a host of benefits:

- Steady Returns: PPF offers a fixed interest rate, which currently stands at 7.1% per year. This makes it an attractive option for investors seeking stability and consistency in returns.

- Tax Benefits: Contributions made to PPF are eligible for tax deductions under Section 80C of the Income Tax Act, up to a maximum limit of 1.5 lakh rupees per financial year. Additionally, the interest earned and the maturity amount are both tax-free, making it a compelling tax-saving instrument.

- Safety and Security: Being a government-backed scheme, PPF is considered a safe investment avenue, providing a sense of security to investors.

- Lock-in Period and Withdrawals: PPF comes with a lock-in period of 15 years. However, partial withdrawals are allowed from the 7th year onwards, providing liquidity in times of need.

ELSS (Equity Linked Savings Scheme)

ELSS, on the other hand, offers a different investment proposition:

- Market-Linked Returns: ELSS invests primarily in equities and equity-related instruments, offering the potential for higher returns compared to traditional fixed-income instruments like PPF. However, returns are subject to market fluctuations, making it more volatile.

- Tax Benefits: Similar to PPF, investments in ELSS qualify for tax deductions under Section 80C, up to a limit of 1.5 lakh rupees per annum. However, unlike PPF, capital gains tax applies to the redeemed amount, albeit with certain benefits like long-term capital gains tax exemption up to a certain limit.

- Flexible Investment Amount: ELSS does not have a maximum investment limit, allowing investors to invest as per their financial goals and tax planning needs.

- Lock-in Period: ELSS comes with a lock-in period of 3 years, which is shorter compared to PPF. This provides investors with relatively quicker access to their funds.

Read: Investing in ELSS Mutual Funds

Choosing the Right Investment Option

The decision between PPF and ELSS depends on various factors such as risk tolerance, investment horizon, financial goals, and tax planning needs. Here’s a simplified guide:

Opt for PPF If

- You have a lower risk tolerance and prioritize capital protection over higher returns.

- You seek a guaranteed, fixed-rate of return with tax benefits.

- You have a long-term investment horizon and can commit to the 15-year lock-in period.

Consider ELSS If

- You have a higher risk tolerance and are comfortable with market volatility.

- You aim to maximize returns over the long term and are willing to withstand short-term fluctuations.

- You have a shorter investment horizon or need liquidity within 3 years.

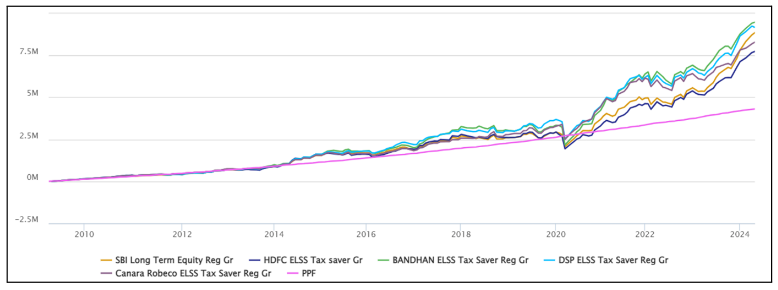

Top 5 ELSS schemes Vs PPF

Option: sip

Frequency: Monthly

Amount: Rs 12,500

Start Date: April 3, 2009

End Date: April 3, 2024

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Start Date | Amount Invested | Scheme Current Value as on 03-04-2024 | Scheme Returns (%) | PPF Current Value (%) | PPF Returns (%) |

| Canara Robeco ELSS Tax Saver Reg Gr | 05-02-2009 | 7332.91 | 1.72 | 03-04-2009 | 2262500 | 8290397.52 | 15.82 | 4311067.37 | 8.14 |

| DSP ELSS Tax Saver Reg Gr | 05-01-2007 | 14147 | 1.66 | 03-04-2009 | 2262500 | 9176522.77 | 16.98 | 4311067.37 | 8.14 |

| HDFC ELSS Tax saver Gr | 05-03-1996 | 13820.09 | 1.74 | 03-04-2009 | 2262500 | 7741499.14 | 15.03 | 4311067.37 | 8.14 |

| BANDHAN ELSS Tax Saver Reg Gr | 26-12-2008 | 6139.72 | 1.75 | 03-04-2009 | 2262500 | 9479822 | 17.35 | 4311067.37 | 8.14 |

| SBI Long Term Equity Reg Gr | 31-03-1993 | 21202.78 | 1.65 | 03-04-2009 | 2262500 | 8857285.89 | 16.57 | 4311067.37 | 8.14 |

Both PPF and ELSS have their own set of advantages and considerations. While PPF offers stability, tax benefits, and security, ELSS provides the potential for higher returns albeit with higher risk. Ultimately, the choice between the two depends on your financial objectives, risk appetite, and investment preferences. It’s advisable to consult with a financial advisor to determine the most suitable option based on your unique circumstances.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.