In the world of finance, the battle against bad loans is a relentless struggle that banks must face head-on. In India, this financial tussle has taken on a new dimension, with private sector banks (PVBs) displaying a remarkable level of aggression in writing off bad loans when compared to their public sector counterparts (PSBs). The objective: to cleanse the balance sheets of these non-performing assets and improve their impaired loan ratio.

The Write-Off Game

The numbers paint a clear picture. According to the Reserve Bank of India’s latest financial stability report, the write-offs to gross non-performing assets (GNPAs) ratio of PVBs in the financial year 2023 stood at a substantial 47.9%. In contrast, PSBs recorded a much lower ratio of 22.2% during the same period.

To demystify this ratio, it’s crucial to understand that it represents the proportion of write-offs (including technical/prudential write-offs and compromise settlements) during a financial year concerning the GNPA at the beginning of that year. In simple terms, it signifies a formal recognition in the financial statements that a borrower’s asset no longer holds any value, often a course of action when a loan is 100% provisioned, and there are bleak prospects of recovery.

Know: GNPA and NNPA In The Banking Industry

But why are private sector banks racing ahead in this game? Banking experts suggest that reduced GNPA ratios significantly improve market sentiments towards their stock. And for PVBs, it’s an essential tool as they frequently raise capital in the form of equity or debt, far more often than PSBs.

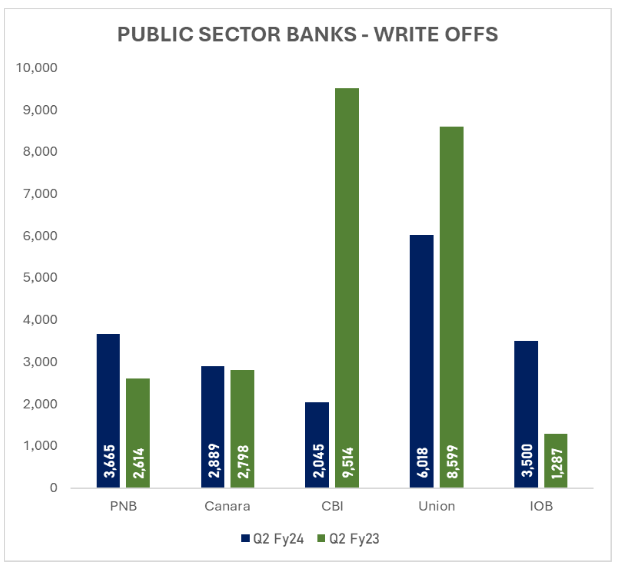

In Rs. Crore

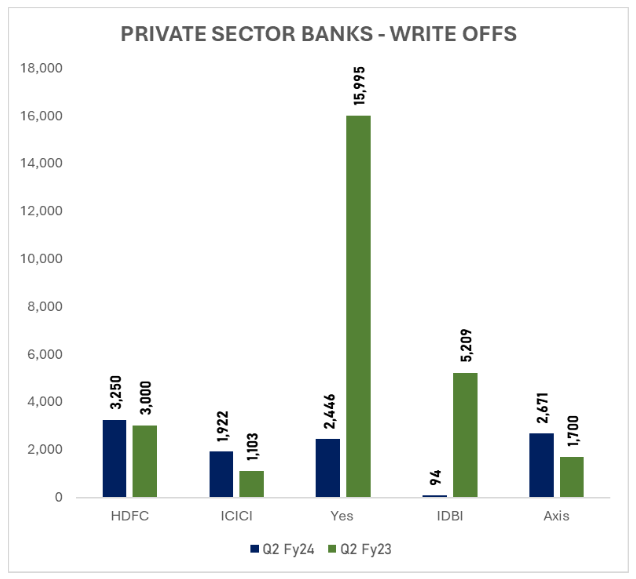

In Rs. Crore

ICICI Bank’s Perspective

Sandeep Batra, Executive Director of ICICI Bank, offered insights into the bank’s approach to write-offs. He emphasized that the write-offs in the current quarter are part of a routine process, closely aligned with the bank’s established policy. In fact, ICICI Bank had recorded write-offs of Rs 1,158 crores in the first quarter of FY23.

Numbers Across Banks

The trend of write-offs extended beyond ICICI Bank. Axis Bank saw its write-offs increase from Rs 1,700 crores to Rs 2,671 crores. Meanwhile, HDFC Bank, the country’s largest private lender, wrote off Rs 3,250 crores in the July-September quarter, a slight uptick from the Rs 3,000 crores reported in the previous year.

Check: HDFC Bank’s PAT Growth

State-Run Banks in the Mix

State-run banks also witnessed changes in their write-off figures. Punjab National Bank saw its loan write-offs jump from Rs 2,614 crores to Rs 3,665 crores. Similarly, Canara Bank’s write-offs increased to Rs 2,889 crores from Rs 2,798 crores. These numbers reflect the evolving dynamics within the banking sector and the routine nature of the write-off process.

The Technical Write-Off Norm

PVBs, the write-off process often includes technical write-offs, and it’s considered more of a norm. These banks are in a better position to make higher provisions, thanks to their stronger net interest margins and non-interest income accounting for a substantial 30% of their total income.

One striking observation is that unsecured advances, including credit cards, tend to be progressively written off by PVBs once they are identified as non-performing. It’s not unusual for a PVB to write off an unsecured account even within the first year of it becoming impaired. In sharp contrast, PSBs follow a more conservative approach, with write-offs usually occurring after a two-year period, even when provisions are available.

The Implications

As we delve deeper into this financial strategy, it’s apparent that the private sector’s approach carries implications not only for their own balance sheets but for India’s banking landscape as a whole. The write-off game isn’t just an accounting exercise; it has real-world consequences for the market, investors, and the economy.

Market Sentiments

Private sector banks, by more aggressively writing off bad loans, enhance market sentiments towards their stocks. The improved outlook makes it easier for them to attract capital, allowing for growth and expansion.

Investor Confidence

Investors find confidence in banks that proactively deal with non-performing assets. The higher the write-off ratio, the more faith investors place in a bank’s ability to manage its balance sheet effectively.

Economic Stability

A healthier banking sector contributes to the overall economic stability of the country. Banks with cleaner balance sheets are better equipped to support lending, which is essential for economic growth.

Conclusion

The differing approaches of PVBs and PSBs in dealing with bad loans highlight the dynamism of the Indian banking sector. It reflects the market’s demand for transparency, proactive risk management, and effective balance sheet management. Both PVBs and PSBs play critical roles in India’s financial landscape, and their unique strategies have their place in the broader economic picture.

In the coming years, it will be interesting to observe how this financial tug-of-war evolves and how it shapes the trajectory of India’s banking sector. Will the private sector’s aggressive write-offs continue to set the tone, or will public sector banks adapt to the changing market dynamics?