As the saying goes, “When one takes a keen interest in a company and thoroughly reads its annual report, they have already embarked on a journey that often surpasses the achievements of 98% of investors. If one delves even deeper and meticulously examines the accompanying notes, they position themselves to outperform over 100% of their peers in the financial world.”

Annual reports are invaluable documents that offer comprehensive insights into a company’s financial health, performance, and future prospects. These reports play a crucial role in helping investors, analysts, and stakeholders make informed decisions. However, decoding the information presented in these reports can be a daunting task for many.

Here is a step-by-step guide to reading and decoding company Annual Reports

Step 1: Understanding the Structure

Indian annual reports typically follow a structured format, making it easier for readers to locate specific information. The primary components of an annual report include:

Source: Man Infra Construction Limited Annual Report (FY 2023)

- Executive Insights and Analysis: Delve into the Managing Director’s (MD) or Chief Executive Officer’s (CEO) message for a high-level overview of the company’s performance, strategic direction, and insights into the industry’s outlook. Complement this with the Management Discussion and Analysis (MD&A), which provides a detailed narrative of financial results, operations, challenges, risks, and opportunities. Pay close attention to the management’s future plans and strategies for a comprehensive understanding of the company’s performance and vision.

- Financial Statements: The heart of the annual report lies in the financial statements. Key components include the Balance Sheet, Profit and Loss Statement, and Cash Flow Statement. These documents provide a snapshot of the company’s financial performance over the past year.

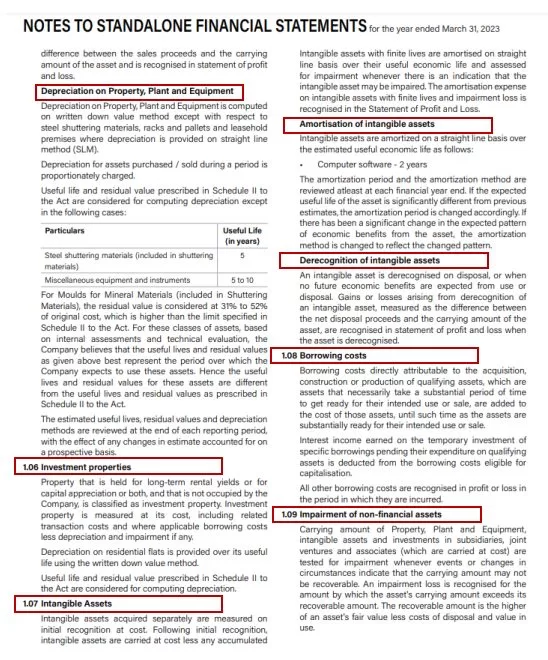

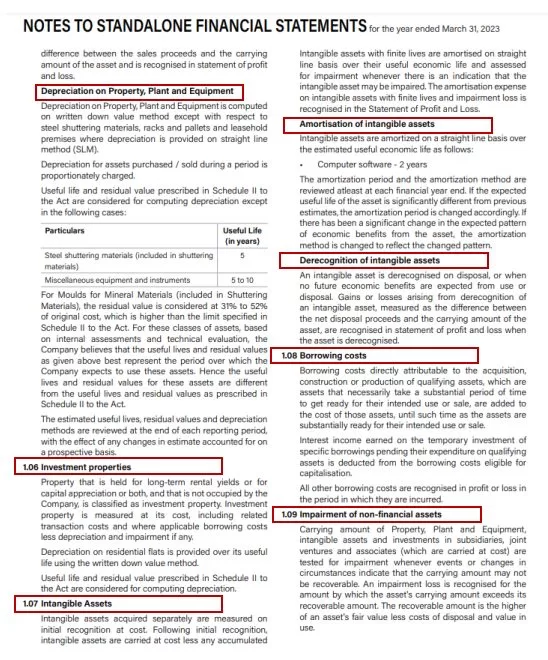

- Notes to Financial Statements: The notes contain essential information about accounting policies, significant accounting estimates, and explanations of line items in the financial statements. Understanding these notes is crucial for decoding the numbers.

- Directors’ Report: This section includes details about corporate governance, the board of directors, and significant events during the year. It also covers regulatory and compliance information.

- Auditor’s Report: The auditor’s report provides an opinion on the fairness of the financial statements. Read this to understand if there are any red flags or qualifications. 4 types of audit opinions

- Unqualified Opinion (Clean Report) – Confirms compliance with standards.

- Qualified Opinion (Modified Report) – Highlights issues affecting statements, e.g., unresolved going concern matters.

- Disclaimer of Opinion – Arises from audit limitations or disagreements on accounting policies.

- Adverse Opinion – Signifies material disagreements making statements misleading.

- Shareholder Information: This section contains details about shareholding patterns, dividends, and meetings. It is handy for investors.

Step 2: Key Topics to Read and Decode

- Financial Performance: Start by analyzing the financial statements. Look for trends in revenue, profit margins, and expenses. Assess the company’s liquidity and solvency positions by examining the balance sheet. Pay attention to any significant changes from the previous year.

- Cash Flow Analysis: The cash flow statement is a crucial document for understanding how the company generates and utilizes cash. Focus on the operating, investing, and financing activities to determine the company’s cash flow health.

- Key Ratios: Calculate and analyze important financial ratios like the Price-to-Earnings (P/E) ratio, Debt-to-Equity ratio, and Return on Equity (ROE). These ratios can help you assess the company’s financial stability and growth potential.

- Risk Factors: Delve into the MD&A section to identify and understand the risks the company faces. These can include industry-specific challenges, regulatory changes, or economic uncertainties. Evaluate how the management plans to mitigate these risks.

- Management’s Strategy: Read the Chairman’s message and MD&A to grasp the company’s strategic goals and future plans. Consider whether these align with the company’s financial performance.

- Dividends and Shareholder Information: If you’re an investor, focus on the dividend history and dividend payout policies. This information can be vital for income-focused investors.

- Corporate Governance and Compliance: Check the directors’ report for insights into corporate governance practices. Understand how the company complies with regulations and if there have been any corporate governance violations.

Read: Low P/E Stocks A Great Bargain Or A Trap?

Step 3: Decoding the Language

Annual reports are laden with industry-specific jargon and technical language. To decode them effectively:

- Glossary: Most annual reports include a glossary or definitions section to explain technical terms and abbreviations. Refer to this when you encounter unfamiliar terms.

- Notes to Financial Statements: The notes section is where complex accounting policies and estimates are explained. Don’t skip this section, as it can provide clarity on how certain numbers were calculated.

Source: Man Infra Construction Limited Annual Report (FY 2023)

- Comparisons: Compare the current year’s report with previous years’ reports. This will help identify trends and deviations in performance.

- External Resources: If something remains unclear, seek information from external sources, such as financial news websites or industry reports.

Know How Companies Cook the Books

Conclusion

Reading and decoding Indian company annual reports is an essential skill for investors and analysts. By understanding the structure, key topics, and language of these reports, you can make more informed decisions and gain a deeper insight into a company’s financial health and prospects.

Remember that practice and continuous learning are key to mastering this skill, so don’t be discouraged if it seems overwhelming at first. Over time, reading annual reports will become a valuable part of your investment strategy.