When it comes to managing a business, numbers don’t lie. Among the many metrics that offer insights into a company’s financial health, the inventory turnover ratio stands out as a powerful indicator. This seemingly unassuming figure is like a secret code, revealing the efficiency of your business operations and helping you make informed decisions.

Understanding the Inventory Turnover Ratio

At its core, the inventory turnover ratio is a simple concept with profound implications. It tells you how many times your company’s inventory is sold and replaced over a given period. The magic lies in what this number reveals.

A high ratio indicates that your products are flying off the shelves, while a low ratio suggests that items are languishing in your warehouse.

The Key Benefits of a High Inventory Turnover Ratio

- Optimized Inventory Levels: A high ratio means you’re maintaining just enough inventory to meet customer demand, reducing carrying costs and the risk of unsold goods.

- Improved Cash Flow: With inventory moving swiftly, you free up capital that can be invested in other areas of your business, such as expansion or research and development.

- Faster Response to Market Changes: A high turnover ratio enables you to adapt quickly to market shifts by adjusting your inventory and product offerings accordingly.

- Lower Holding Costs: Reduced storage, insurance, and obsolescence costs contribute to higher profitability.

Read: The Power of Free Cash Flow

Calculating the Inventory Turnover Ratio

The formula for calculating the inventory turnover ratio is simple:

To Break It Down:

- Cost of Goods Sold (COGS): This is the total cost of all goods sold during a specific period. It includes the cost of raw materials, labour, and overhead expenses.

- Average Inventory: Calculate the average inventory over the same period by adding the beginning and ending inventory and dividing by 2.

Example:

Imagine you run a bakery. Your COGS for a year are Rs. 3,00,000, and your average inventory is Rs. 20,000.

Inventory Turnover Ratio= 3,00,000/20,000=15

This means, on average, you sold and replaced your inventory 15 times in a year.

Interpreting the Results

So, what does a high or low inventory turnover ratio tell you?

- High Ratio: A ratio greater than 1 implies efficient operations. However, excessively high ratios might indicate understocking, which could lead to lost sales.

- Low Ratio: A ratio less than 1 suggests inefficiency and overstocking. Products may remain on the shelves for extended periods, tying up capital.

Tailoring Your Approach

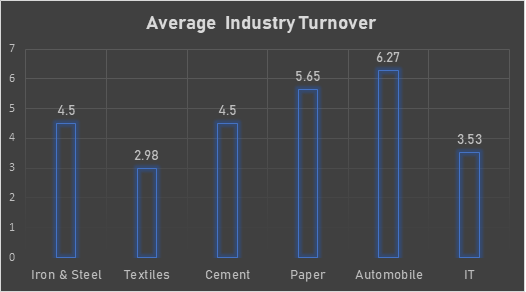

It’s crucial to understand that an ideal inventory turnover ratio varies by industry. For instance, a high-end jewelry store will naturally have a lower ratio than a fast-food restaurant. To truly harness the power of this metric, benchmark your performance against your peers in the same sector.

Improving Inventory Turnover Ratio

- Smart Forecasting: Invest in demand forecasting to avoid overstocking or understocking issues.

- Just-in-Time Inventory: Adopt a just-in-time approach to receive inventory when needed, reducing carrying costs.

- Clearance Sales: Host occasional clearance sales to move slow-moving inventory.

- Supplier Relationships: Negotiate favourable terms with suppliers to maintain lower inventory levels.

- Regular Auditing: Routinely audit your inventory to identify slow-moving items that can be discounted or discontinued.

In conclusion, efficient inventory management is a cornerstone of successful business operations. It ensures the availability of raw materials for manufacturing without excess, reduces the risk of inventory write-offs, and maximizes the timely sale of finished goods. Investors keen on evaluating a company’s efficiency can employ the inventory turnover ratio.

Know: How to Read the Annual Report

By assessing its absolute value and trends, and comparing it with industry peers, investors gain valuable insights into a company’s inventory management and overall health.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.