So, you want to earn profit from unexpected movements in share prices before any event, such as upcoming quarterly results or the upcoming budget? The movement in stock price during these events is unpredictable, with the possibility of being on the right side always at 50%. You may be correct or incorrect. Everyone desires to move in the right direction and relish the ride with handsome profits. Discovering the best strategy to make money before any event is akin to having a sword in hand. However, its effectiveness depends entirely on the sentiment prevailing at that time and the direction of price movement.

Long Straddle

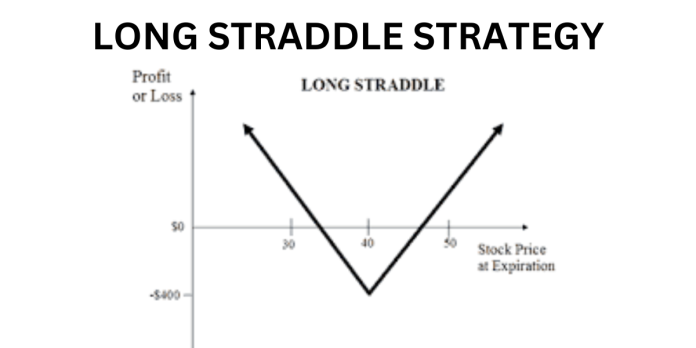

A Long Straddle is where we go long both the Call and Put of a particular stock. A long straddle is established at a net debit (or cost) and yields profits if the underlying stock rises above the upper break-even point or falls below the lower break-even point, while both options have the same underlying stock, strike price, and expiration date.

| Call/ Put | Lot | Strike Price | Expiry Day | Cost Rs |

| Call Option | 1 | 100 | 25-Jan | 3.2 |

| Put Option | 1 | 100 | 25-Jan | 3.3 |

What will be the breakeven point for the above example? There will be two potential breakeven sides as the strategy yields profits regardless of the stock movement in either direction. As it is a debit strategy with a total cost of around Rs 6.5, this implies that the breakeven point will be Rs 106.50 (100 + 6.5) for the upside and Rs 93.50 (100 – 6.5) for the downside. Beyond these points, the strategy will begin generating profits.

Read: What is Synthetic Straddles in Options Trading?

Unlimited Profit with Limited Loss

The profit potential on the upside is unlimited since the stock price can continue rising without a predefined limit. The potential loss, however, is confined to the total cost of the straddle along with commissions. This potential loss is realized only if the position is maintained until expiration, leading to both options expiring as worthless. However, if someone intends to capture the movement only on the event day itself, then they should also consider other factors.

Price moves on either side make money, “BUT”

Traders frequently utilize straddles before significant events such as earnings reports, new product launches, or any major announcements. These situations often involve the potential for either ‘good news,’ which could significantly boost the stock price, or ‘bad news,’ which could sharply decrease it. However, conversely, the risk in this scenario arises if the announcement fails to generate a significant change in the stock price. This can lead to disappointment, especially for those who purchased the straddle a day or two days prior as they would have to bear the theta, which represents the cost related to the passage of time before closing the position.

Many traders employ this strategy just before earnings results are released. The dates of important announcements are typically widely known in the marketplace. However, while these announcements are anticipated to have a significant impact on the stock price, it’s important to note that such changes are not guaranteed.

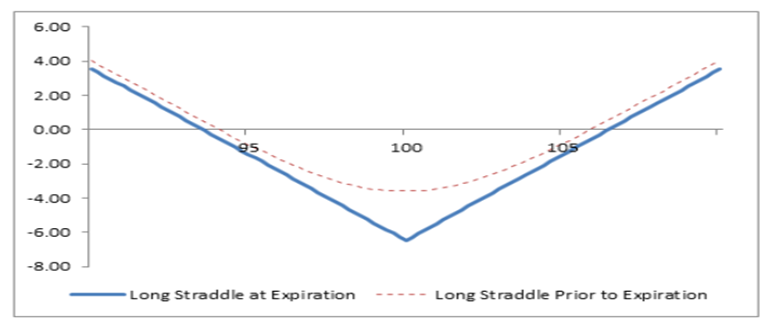

Consequently, prices of calls, puts, and straddles often experience an increase before these announcements. In options terminology, this phenomenon is referred to as an ‘increase in implied volatility. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices.

Heightened implied volatility amplifies the risk associated with trading options. Those purchasing options face increased costs, thereby escalating their risk exposure. For straddle buyers specifically, elevated option prices result in wider breakeven points, demanding a more significant movement in the underlying stock price to reach breakeven levels.

Additionally, following the event, there is typically a decrease in implied volatility, which was previously heightened due to unpredictability. This decrease results in losses due to purchasing at elevated rates and selling at decreased rates.

On the other hand, sellers of straddles encounter heightened risk as well. The escalated volatility signifies a higher likelihood of substantial stock price fluctuations, consequently increasing the probability of loss for option sellers.

Also Read: Option Chain Analysis: Determining Support And Resistance

Conclusion

Buying a straddle appears to be a wise choice for harnessing the substantial fluctuations in stock prices on either side before any event. However, there are two major risks associated with it, despite its appeal due to limited loss and lower capital requirements. The first risk lies in the situation where the anticipated event fails to significantly impact the stock price or only causes a minor movement, resulting in the options not yielding profits. The second risk is related to implied volatility, influenced by widely known yet unpredictable events that trigger an increase in volatility. This surge in implied volatility escalates option prices, consequently leading to larger breakeven points.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.