Options trading offers a world of possibilities for investors, and the iron condor strategy is a remarkable example of how sophisticated techniques can be used to navigate a variety of market conditions. In this article, we will unravel the iron condor options strategy, step by step, demystifying its components, construction, and potential outcomes.

Whether you’re a seasoned trader or just stepping into the world of options, understanding the basics is crucial. So, let’s start by diving into the types of options: ATM, OTM, and ITM.

Types of Options

Before we delve into the intricacies of the iron condor strategy, let’s acquaint ourselves with three essential types of options:

- ATM (At the Money): An ATM option has a strike price that is closest to the current market price of the underlying asset. (19,450)

- OTM (Out of the Money): On the other hand, an OTM option has a strike price that is not profitable to exercise at the current market price. It possesses no intrinsic value but retains time value.

(Call strikes at 19550 or above 19,550are OTM, Put strikes at 19350 or below are OTM) - ITM (In the Money): An ITM option boasts a strike price that would yield a profit if exercised at the current market price. ITM options combine intrinsic value, arising from their favourable strike price, and time value.

(Call strikes at 19350 or below 19350 are ITM, Put strikes at 19550 or above 19550 are ITM)

| Call Delta | Call LTP (Rs) | Strike | Put LTP (Rs) | Put Delta |

| 0.99 | 428.3 | 19000 | 0.65 | -0.01 |

| 0.99 | 377.65 | 19050 | 0.8 | -0.01 |

| 0.98 | 328.9 | 19100 | 1.05 | -0.02 |

| 0.98 | 277.75 | 19150 | 1.3 | -0.02 |

| 0.96 | 229.9 | 19200 | 2.05 | -0.04 |

| 0.94 | 180.1 | 19250 | 3.05 | -0.06 |

| 0.89 | 134.5 | 19300 | 5.95 | -0.11 |

| 0.78 | 91.9 | 19350 | 13.3 | -0.22 |

| 0.61 | 56.8 | 19400 | 28.35 | -0.39 |

| 0.42 | 32.9 | 19450 | 56 | -0.58 |

| 0.26 | 18.35 | 19500 | 90.1 | -0.74 |

| 0.15 | 8.95 | 19550 | 132.95 | -0.85 |

| 0.08 | 4 | 19600 | 176.45 | -0.92 |

| 0.03 | 1.65 | 19650 | 224.3 | -0.97 |

| 0.02 | 0.9 | 19700 | 273.85 | -0.98 |

| 0.01 | 0.7 | 19750 | 321.95 | -0.99 |

| 0.01 | 0.7 | 19800 | 371.9 | -0.99 |

| 0.01 | 0.7 | 19850 | 422.45 | -0.99 |

Read: The Power of Delta – Option Greeks

Now that we’ve got our basics in place, let’s embark on the journey to understand the intriguing iron condor strategy.

What is the Iron Condor Strategy?

In straightforward terms, the Iron Condor Strategy is akin to strategically navigating the stock market with a safety net. It involves creating a short strangle but with the added security of purchasing out-of-the-money (OTM) options to limit potential risks. This approach provides a unique avenue to engage with stocks without committing to a specific direction. The strategy thrives as time passes and market uncertainty decreases, capitalizing on the subtle dynamics of implied volatility (IV). Essentially, it’s a tactic tailored to benefit from a stock’s stability, making it particularly relevant when anticipating limited movement and a reduction in volatility, especially in the lead-up to earnings announcements.

Understanding an Iron Condor

The iron condor strategy is designed to be delta-neutral, signifying its indifference to minor fluctuations in the underlying asset’s price. In simple terms, it aims to earn a maximum profit when the asset’s price remains within a specific range.

The Construction of the Strategy:

The iron condor involves four options contracts with the same expiration date:

- A long out-of-the-money (OTM) put option to protect against significant downward movements.

- A short OTM put option closer to the current price of Nifty

- A short OTM call option, with a strike price above the current price of Nifty.

- A long OTM call option to safeguard against substantial upward movements.

Read: Unlocking OTM Call Options: Strategies for Futures & Options

Important point

The delta values of the two short positions should counterbalance each other. For instance, consider selling a 19,700-call option with a delta of approximately 0.02 and simultaneously selling a 19,150 put option. In this scenario, the delta of one option offsets the delta of the other, even though it might not always be possible to find perfectly delta-neutral strike prices.

Step 1: Short Call (Bearish leg)

You start by selling an OTM call option with a strike price above the current Nifty Level of 19450. In this case, we choose the 19550-call option, which is above the ATM Strike

Step 2: Buy a Further OTM Call (Bearish leg)

To limit potential losses, you buy a call option with an even higher strike price. In this example, let’s choose the 19600-call option.

Step 3: Short Put (Bullish leg)

Simultaneously, you sell a put option with a strike price below the current Nifty Level of 19450. In this case, we choose the 19300 put option.

Step 4: Buy a Further OTM Put (Bullish leg)

To limit potential losses on the put side, you buy a put option with a higher strike price. In this example, let’s choose the 19250 put option.

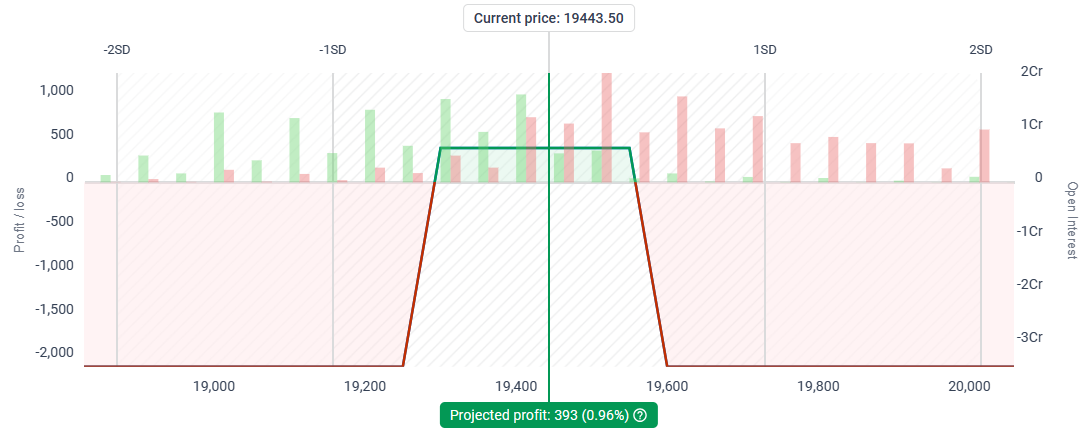

Iron Condor Structure:

- Short 1 Nifty 19550 Call

- Buy 1 Nifty 19600 Call

- Short 1 Nifty 19350 Put

- Buy 1 Nifty 19300 Put

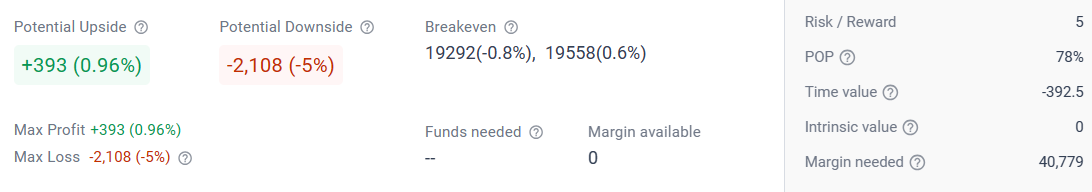

Information about the trade (Images are from Sensibull)

The strategy gets its name from the diagram showing its potential profits and losses, which resembles a bird with wings outspread. Some traders use like iron condors because they come with limited theoretical risks — but that can also mean limited potential profits. An Iron Condor is used when you expect the underlying asset’s price to remain within a specific range. It’s a strategy for generating income from options premiums in a non-volatile or sideways market.

Also Read: What Is A Box Spread Strategy?

Conclusion:

The Iron Condor is a versatile strategy that allows options traders to profit from low volatility scenarios. By selling both a call and a put option and simultaneously buying further out-of-the-money options for protection, you can generate income while capping your potential losses. It’s a valuable tool in an options trader’s toolkit to navigate different market conditions.

The construction of the strategy might seem complex, but its limited risk and potential for profit make it a compelling approach to capitalize on low market volatility.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.