Ever felt lost in the labyrinth of home insurance premiums? Brace yourself for a revelation. Get ready to save big and secure your home without breaking the bank. Let’s dive into the secrets that insurance companies don’t want you to know!

The Foundation: Risk Assessment

Home insurance premiums aren’t arbitrary; they are meticulously calculated based on risk assessment factors. Let’s explore the key elements influencing these calculations:

Property Value:

Higher property value means higher risk, resulting in increased premiums.

Location:

Homes in disaster-prone areas have higher premiums due to elevated risk.

Construction Type and Features:

Safety features like fire alarms can lower premiums, while the type of construction influences costs.

Claims History:

A history of frequent claims raises the risk profile, leading to higher premiums.

Credit Score:

Surprisingly, a good credit score can result in lower premiums, indicating responsible financial behaviour.

Decoding the Calculations: A Practical Example

Let’s dive into a practical example to demystify premium calculations. Consider owning a Rs. 1 crore two-bedroom apartment in a city. With features like fire alarms and a moderate earthquake risk, your annual premium might hover around Rs. 20,000.

Breaking Down the Premium Components

Dwelling Coverage:

Protects the structure against perils like fire, theft, and natural disasters.

Personal Property Coverage:

Safeguards personal belongings from covered perils.

Liability Coverage:

Shields against financial claims from injuries or property damage caused by others on your property.

Additional Coverage:

Optional coverage for risks like floods or earthquakes may be added for an extra cost.

Balancing Coverage and Cost: Striking the Right Balance

Finding the equilibrium between coverage and cost is crucial. Extensive coverage provides comprehensive protection but increases premiums. On the other hand, minimal coverage may save money but exposes you to financial risks.

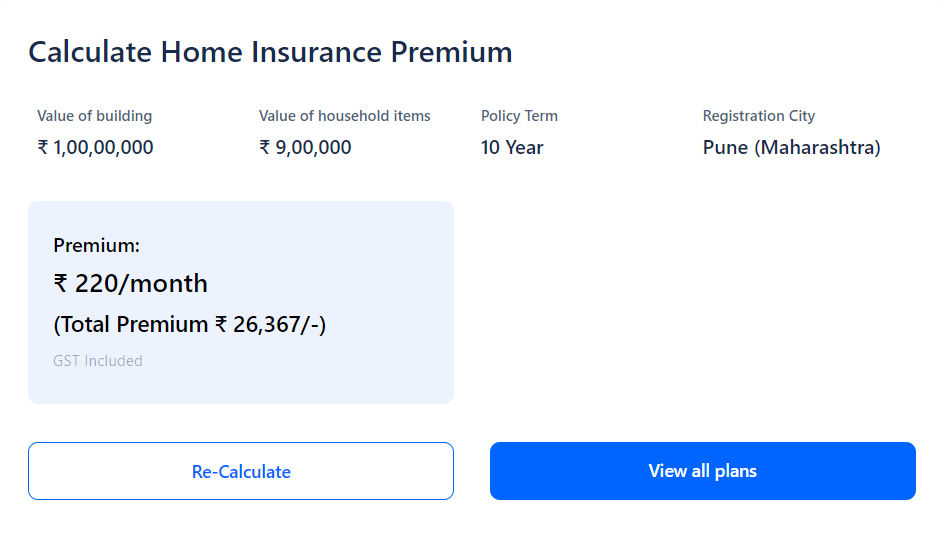

Insurance Calculator:

Source: Policy Bazaar

Tips for Lower Premiums: Navigating the Maze

Shop Around and Compare Quotes:

Obtain quotes from multiple insurers to find the best deal.

Increase Your Deductible:

Opting for a higher deductible can lower premiums.

Bundle Policies:

Combine home insurance with other policies for potential discounts.

Install Safety Features:

Implement measures like fire alarms and security systems to reduce risk and potentially lower premiums.

Maintain Your Property:

Regular maintenance minimizes the likelihood of damage and claims.

Review Your Coverage Regularly:

Revisit your coverage as property value and risk factors change to ensure it remains adequate and cost-effective.

Conclusion

Understanding home insurance calculations empowers you to make informed decisions about coverage and premiums. By considering risk assessment factors, exploring coverage options, and implementing risk-reduction measures, you can navigate the maze with confidence.

Know More:

Disclaimer: This blog has been written exclusively for educational purposes. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.