When it comes to the world of investment banking and equity research, two distinct but interdependent roles take center stage: the sell side and the buy side. These roles play a pivotal part in the intricate process of investment, and understanding the differences between them can shed light on how the financial world operates.

The sell side and buy side, while both involved in investment research, have contrasting goals and purposes. In a nutshell, the sell side focuses on delivering research and recommendations, while the buy side takes these recommendations and transforms them into investment decisions.

Read: 10 Things To Consider Before Making An Investment Decision

The Sell Side:

Equity research firms and analysts belonging to the sell side are characterized by their analysis of companies, the coverage they provide, and their recommendations. Sell-side analysts offer specific recommendations to buy, hold, or sell a particular security. These recommendations are rooted in the analysts’ expectations of a company’s earnings and their predictions regarding the future price performance of the security (price target). Typically, sell-side analysts work for firms that provide investment banking, broking, and advisory services to clients. Independent analysts constitute another category within the sell side, working for research originators who sell their research on a subscription basis to various clients, including investors, institutions, investment bankers, regulators, and fund managers.

Sell-side analysts collaborate closely with their clients to identify potential investment opportunities, ideas, and trades through rigorous research and analysis. Their recommendations are based on factors such as a company’s financial performance, position, future growth prospects, and forecasts. The reports published by the sell side are quantitative in nature, with a strong focus on projections for the future, aiming to provide a clear and attractive financial picture for investors.

The Buy Side:

In contrast, the buy side operates on the premise that research from the sell side is a valuable resource to inform investment decisions. Buy-side analysts work for money managers such as mutual funds, hedge funds, pension funds, and portfolio managers. Their primary responsibility is to purchase and sell securities, either for their own investment accounts or on behalf of their clients.

Buy-side analysts scrutinize the recommendations provided by the sell side and ultimately decide whether or not to invest. The reports generated on the buy side are qualitative, focusing on the rationale behind capital appreciation. These reports are strictly for internal use and are not made publicly available.

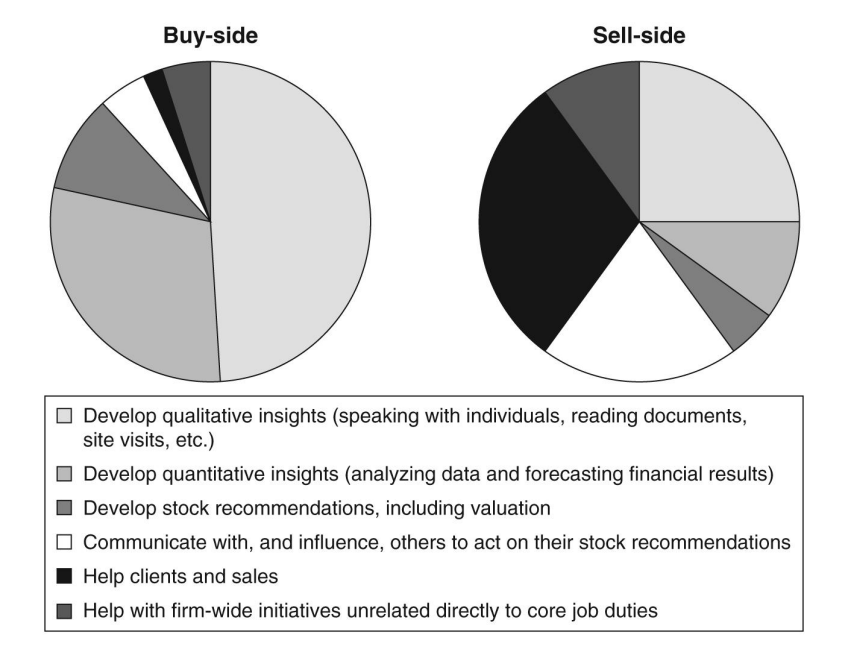

Here is the interesting data showing how the sell side and buy side utilise their time to make result-oriented recommendations for their stakeholders:

Exhibit 1.1 Time Allocation for Buy side and Sell side.

Source: James J. Valentine. – Best practices for equity research analysts_ essentials for buy-side and sell-side analysts _ (c2011., McGraw-Hill,)

Skillset – Sell Side Vs. Buy Side

| Skill / Responsibility | Sell-Side Analyst | Buy-Side Analyst |

| Analytical Skills | Excellent analytical and quantitative skills | Strong and intellectual eye for investment opportunities |

| Communication Skills | Strong writing and communication skills | Ability to create productive, timely, and high-quality reports for investment decisions |

| Financial Analysis | Expertise in Microsoft Office suite – Excel, PowerPoint, and Word | Expertise in Microsoft Office suite – Excel, Word, and PowerPoint |

| Information Sources | Conduct independent research and analysis, creating publicly available reports | Utilize sell-side analysts’ reports and conduct additional analysis internally |

| Investment Decision | Recommend buy or sell decisions for specific securities | Make investment decisions aligned with company strategy |

| Market Monitoring | Focus on individual companies and their financials | Monitor market developments, industry characteristics, and portfolio performance |

| Report Accessibility | Reports are available in the public domain | Reports are not publicly available |

| Time Commitment | Prioritize tasks and work on multiple engagements | Constantly monitor portfolio performance and stay updated with the economy and global markets |

| Focus Area | Emphasis on specific security recommendations | Focus on building and managing a portfolio to meet investment goals |

To summarize, sell-side analysts produce research reports that contain buy or sell recommendations, while buy-side analysts utilize these reports to make investment decisions in line with their company’s strategy. Both roles demand a robust skillset, including analytical prowess, market awareness, and proficiency in software tools, but their approaches to reporting and decision-making differ significantly.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.