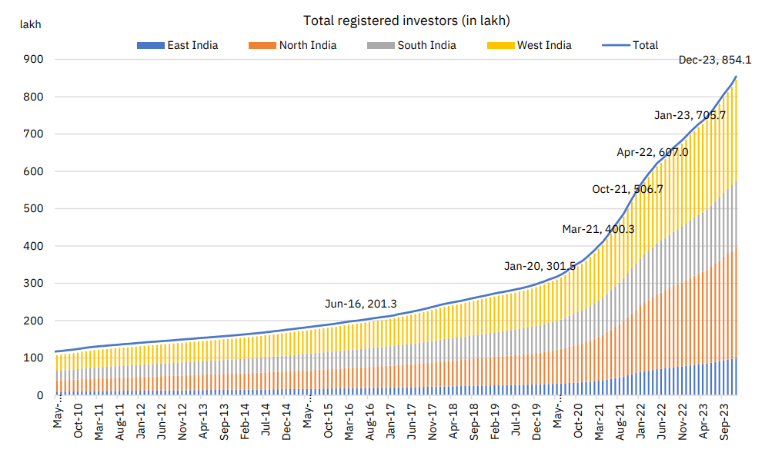

Region-wise distribution of total registered investors

As of December 2023, the total count of registered investors reached 8.5 crore, up from 7.3 crore at the fiscal year’s start. North India retained its leading position with 3 crores of registered investors, followed by West India at 2.7 crore, South India at 1.8 crore, and East India at 1 crore. The number of investors has been growing rapidly, hitting 2 crore in 2016, doubling to 4 crore in 2021, and then doubling again to 8 crore in 2023 in just over two years.

In terms of total registered investors by state, Maharashtra continued to lead with 1.5 crore investors, making up 17.5% of the total. Uttar Pradesh surpassed Gujarat in November 2022 to claim the second spot and has held onto it since, with 90 lakh investors by December end. Following Uttar Pradesh are Gujarat with 77 lakh, and West Bengal and Karnataka with 48 lakh each. Together, these five states accounted for 48.3% of the total investor base as of December 2023.

Region-wise distribution of new investor registrations

New investor sign-ups hit a record high in December 2023, with 21.1 lakh new registrations, marking a 47% increase from November’s 14.3 lakh registrations. This surge represents the highest monthly sign-up rate since May 2019 and is attributed partly to robust returns in the Indian stock market during the preceding month.

All regions experienced growth, with West India leading the pack with a 69% month-on-month increase in registrations (from 3.9 lakh to 6.6 lakh), followed by North India with a 50% increase (from 5.9 lakh to 8.9 lakh), East India with a 31% increase (from 1.9 lakh to 2.5 lakh), and South India with a 21% increase (from 2.7 lakh to 3.2 lakh).

While North India’s share of new registrations saw a slight uptick to 42% in December from 41.2% the previous month, West India’s share rose significantly from 27.1% to 31%. However, this growth came at the expense of a decline in South India’s share from 18.5% to 15.3% and East India’s share from 13.2% to 11.7%. Overall, total investor registrations in the first nine months of FY24 (April to December 2023) reached 1.3 crore, marking a 28.5% increase compared to the same period last year (April to December 2022).

Also Know: Which Indian States embraced personal loans the most?

Maharashtra leads in terms of new investor registrations

After being surpassed by Uttar Pradesh in February 2023, Maharashtra regained the top position in December, with 3 lakh registrations, marking a 50% increase from 2 lakh in November 2023. This accounted for 14.2% of all new registrations in the month. Uttar Pradesh followed closely in second place with 2.9 lakh new investor registrations, a 45% increase from November. Gujarat witnessed a significant surge in new registrations, more than doubling from 1.1 lakh in November to 2.4 lakh in December, representing a 119% month-on-month rise.

Rajasthan and Haryana also experienced an uptick in their share of new registrations, while West Bengal, Tamil Nadu, Bihar, and Karnataka saw a decline. Together, the top five states contributed 48.6% of all new registrations in the first three-quarters of FY24.

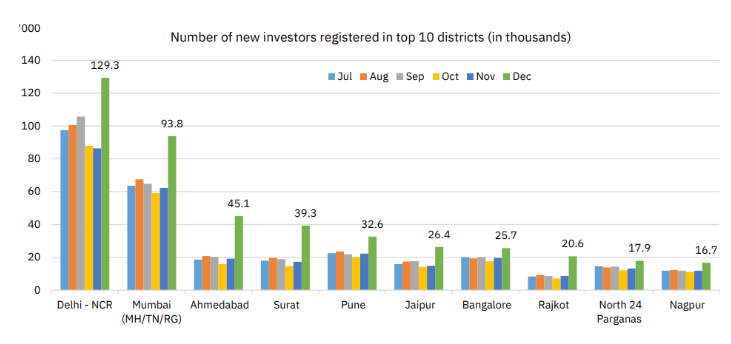

Contribution of the top 10 districts remained relatively stable in December 2023.

New investor registrations continued to be focused in a small number of districts. The share of registrations from the top 10 districts increased slightly from 19.3% in November to 20.9% in December. Despite this, the number of registrations in these districts surged by 59.4% month-on-month, reaching 4.5 lakh.

In December, Delhi recorded the highest number of new investor registrations among all districts, with 1.3 lakh registrations, representing a 49.6% increase from the previous month. Following Delhi, Mumbai saw 94,000 registrations, marking a 50.6% month-on-month increase. Other cities such as Ahmedabad, Surat, and Pune also experienced significant increases in new registrations. Out of the 588 districts, only 29 districts witnessed a month-on-month decline in new investor registrations in December.

In December, Delhi recorded the highest number of new investor registrations among all districts, with 1.3 lakh registrations, representing a 49.6% increase from the previous month. Following Delhi, Mumbai saw 94,000 registrations, marking a 50.6% month-on-month increase. Other cities such as Ahmedabad, Surat, and Pune also experienced significant increases in new registrations. Out of the 588 districts, only 29 districts witnessed a month-on-month decline in new investor registrations in December.

Conclusion

The surge in investor registrations reflects the growing interest and participation in India’s investment opportunities. As India’s economy continues to grow, the investment sector will play a crucial role in driving innovation and economic prosperity. However, stakeholders need to ensure accessibility and inclusivity, allowing investors from all regions to benefit from India’s evolving investment landscape.