In the intricate world of investment, where numbers often take centre stage, it’s easy to overlook a fundamental driver of a company’s success – the quality of its leadership. Let’s embark on a journey beyond balance sheet and stock charts, into the heart of corporate decision-making. Here, we explore the pivotal role played by a company’s management team in shaping its financial destiny.

Resume Review

Commence your assessment by meticulously examining the manager’s resume. Pay particular attention to the duration of their experience; a managerial track record spanning less than a decade warrants careful examination. To gain a holistic understanding, focus on their qualifications and achievements from the past 5 to 10 years. This timeline enables you to connect the dots between their prior roles and current responsibilities.

Path to Executive Leadership

Delve into how top managers ascended to their executive positions. Determine whether they have a background in on-ground operations or if they have predominantly risen through the corporate ranks. For instance, consider the implications of a CFO being promoted to the role of CEO. This transition may raise concerns if the focus shifts towards cost-cutting at the expense of customer experience. Ideally, the best managers often emerge from operational roles, as they possess in-depth knowledge of the company’s inner workings.

Assessing New Managerial Entrants

When a new manager joins the company, closely monitor their initial actions. Swift and significant changes in the early days may serve as a potential red flag. A prudent approach is to question whether the new manager, without an in-depth understanding of the company’s operations and customer base, is making immediate changes. Avoid those managers who have spent most of their careers in the corporate suite or who have served customers in a different type of industry.

Wage Disparity and Employee Concerns

The chasm between top executives’ compensation and that of lower-tier employees can provide valuable insights. A substantial gap may indicate a company prioritizing profits over employee well-being. Investors should take note of this imbalance.

| CEO Annual Pay (Rs in Crores) | Average Annual Pay (Rs in Lakhs) | |

| Infosys | 79.95 | 8.7 |

| Wipro | 64 | 9 |

| TCS | 34 | 8 |

| HCL | 28 | 10 |

| Tech Mahindra | 29 | 5.2 |

| Median | 46.99 | 8.18 |

Read: How The Sudden CEO Departures Impact Stock Prices

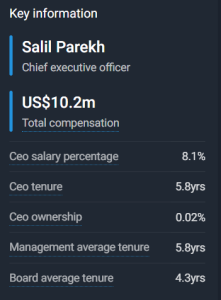

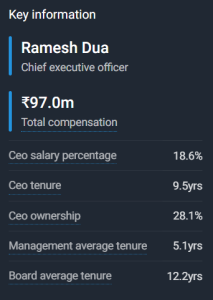

The Salary-Ownership Paradox

Managers with lower salaries and significant ownership stakes tend to exhibit a long-term perspective. Conversely, be cautious of those who primarily hold stock options, as they may focus on short-term gains, possibly through strategies like acquisitions, to boost option values. In certain cases, an exception arises with individuals who exhibit both high ownership stakes and high salaries.

Eicher Motors Infosys

HCL (Exception) Relaxo

Independent vs. Consultant-Driven Compensation

When compensation packages are devised by external consultants hired by the Board of Directors, it’s a red flag. These packages may rely on industry-wide benchmarks rather than considering the company’s unique circumstances. Such one-size-fits-all approaches can be misleading.

Upfront Demands vs. End Results:

Beware of managers who demand exorbitant salaries before even joining a company. Often, those seeking substantial upfront compensation might not deliver commensurate results in the long run. It’s essential to scrutinize their track record and potential value.

Insider Transactions as Signals:

Keep a watchful eye on insider transactions. When managers demonstrate their belief in the company’s future through personal investments, it can signal genuine confidence.

Sundaram Finance Ltd

Promoter Holding which stood at 35.89% on December 31, 2021, saw a notable increase to 38.49% by March 31, 2022, resulting in a remarkable 79.69% return on the increased stake.

Strategic Flexibility

CEOs crafting strategic plans risk becoming overly committed to a single path, potentially missing superior opportunities. Seek managers with adaptability and long-term vision over rigid strategic adherence. The strategic plans that are most prone to failure are those that have an overly focus, such as those that set a financial target. While doing so, the CEO focuses on a specific financial target and neglects other areas or takes on more risk.

Achievement vs. Manipulation

Monitor managers consistently meeting guidance targets. While this is positive, delve into financials to ensure achievement isn’t the result of harmful manipulation, which can detrimentally impact long-term prospects. A CEO and CFO may fear disappointing the analysts because if they do, their stock price plummets.

Centralized vs. Decentralized Management

Assess whether a company’s management is centralized or decentralized. Typically, decentralized structures offer greater efficiency and improved customer experiences, factors to long-term EPS growth. Bureaucratic businesses also tend to have difficulty recruiting and retaining competent employees. Because employees don’t want to take orders without understanding the reason behind them.

In the realm of financial analysis, exceptional managers exhibit a distinct set of traits that contribute to long-term success. Look for leaders who embody ethical values, prioritize the future over shortcuts, thirst for knowledge, foster strategic partnerships, view employees as partners, and hold admiration for unwavering perseverance. These qualities not only enhance a company’s sustainability but also serve as beacons for prudent investment decisions.

Disclaimer:This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.