India’s healthcare landscape is undergoing a transformative surge with a projected market size of US$ 372 billion by 2022, fuelled by increasing income, heightened health awareness, and a surge in lifestyle diseases. This growth is set to create a substantial job market, generating over 5 lakh jobs annually. Furthermore, the nation’s public healthcare expenditure has risen to 2.1% of GDP in FY23, a significant increase from 1.6% in FY21, as outlined in the Economic Survey 2022-23.

With a robust pool of well-trained medical professionals and substantial government backing, including an allocation of Rs. 89,155 crore (US$ 10.76 billion) in the Union Budget 2023-24 and a planned Rs. 500 billion (US$ 6.8 billion) credit incentive program, India’s healthcare sector is poised for dynamic growth and enhanced infrastructure.

Here is a comprehensive overview of the methodology for evaluating healthcare stocks.

Regulatory Environment:

The Indian healthcare industry is subject to stringent regulations, encompassing drug pricing, manufacturing standards, and clinical trial protocols. These regulations can significantly impact the operations and profitability of healthcare companies. Therefore, prospective investors should carefully assess the regulatory environment and its potential implications for the companies they are considering.

Revenue Growth:

Consistent revenue growth over an extended period, ideally five years or more, is a hallmark of a thriving healthcare company. Revenue from operations, or the core business, should exhibit steady growth, indicating sustained demand for the company’s products or services.

Net Profit Growth:

The healthcare industry is characterized by high operating expenses, including bed costs, doctors’ fees, staff salaries, electricity, and machinery maintenance. Amidst these expenses, efficient cost management is paramount for generating net profit growth and creating shareholder value.

Now, let’s explore in greater detail the top three stocks in the healthcare sector that have captured investors’ keen attention.

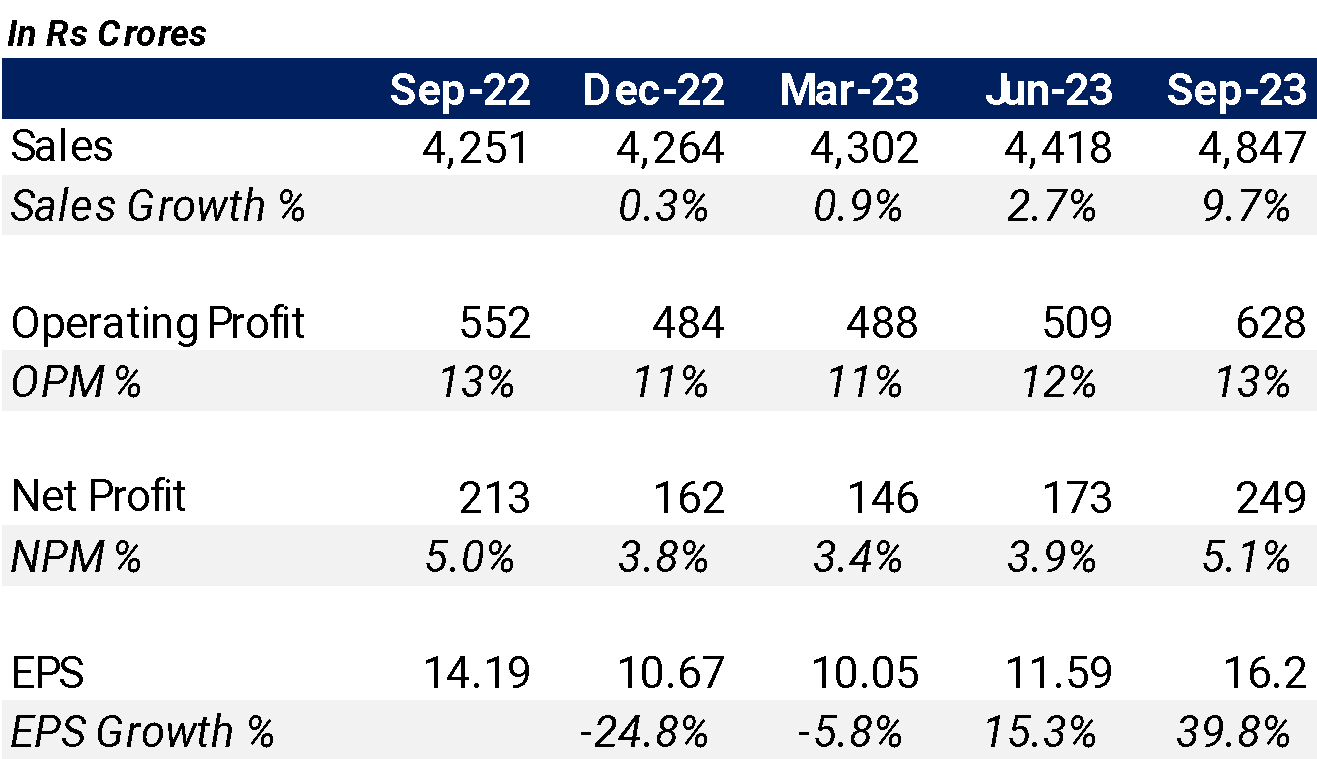

Apollo Hospitals Enterprise Ltd

Established in 1983 by the visionary Dr. Prathap C Reddy, Apollo Hospitals stands as India’s inaugural corporate hospital, spearheading the nation’s private healthcare evolution. Renowned as Asia’s premier integrated healthcare services provider, Apollo boasts a formidable presence across hospitals, pharmacies, primary care and diagnostic clinics, and various retail health models.

Performance

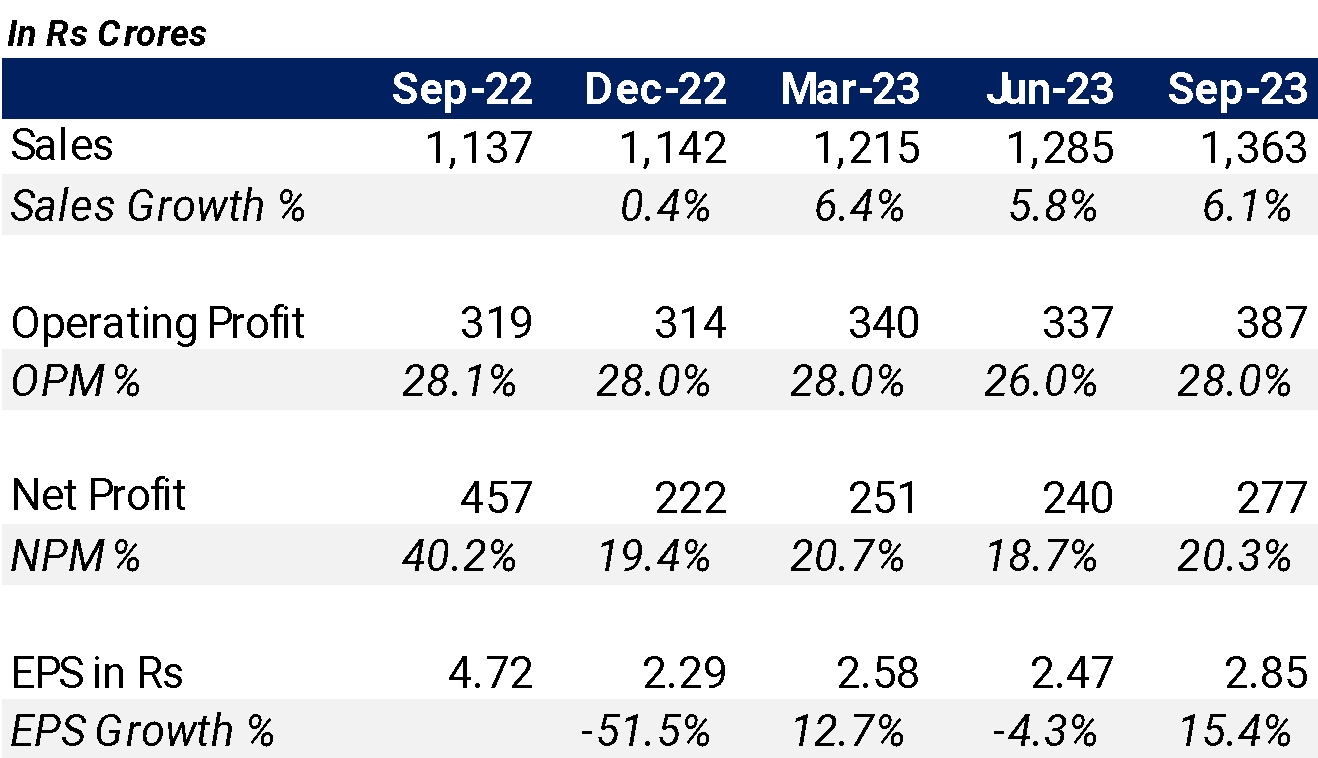

Max Healthcare Institute Ltd

Max Healthcare Institute Limited is a key player in delivering healthcare services through a network of primary care clinics, multi-speciality hospitals, medical centers, and super-speciality hospitals. The company is actively involved in operation and management, offering a spectrum of medical services, clinical care, radiology, pathology services, and other related healthcare services.

Performance

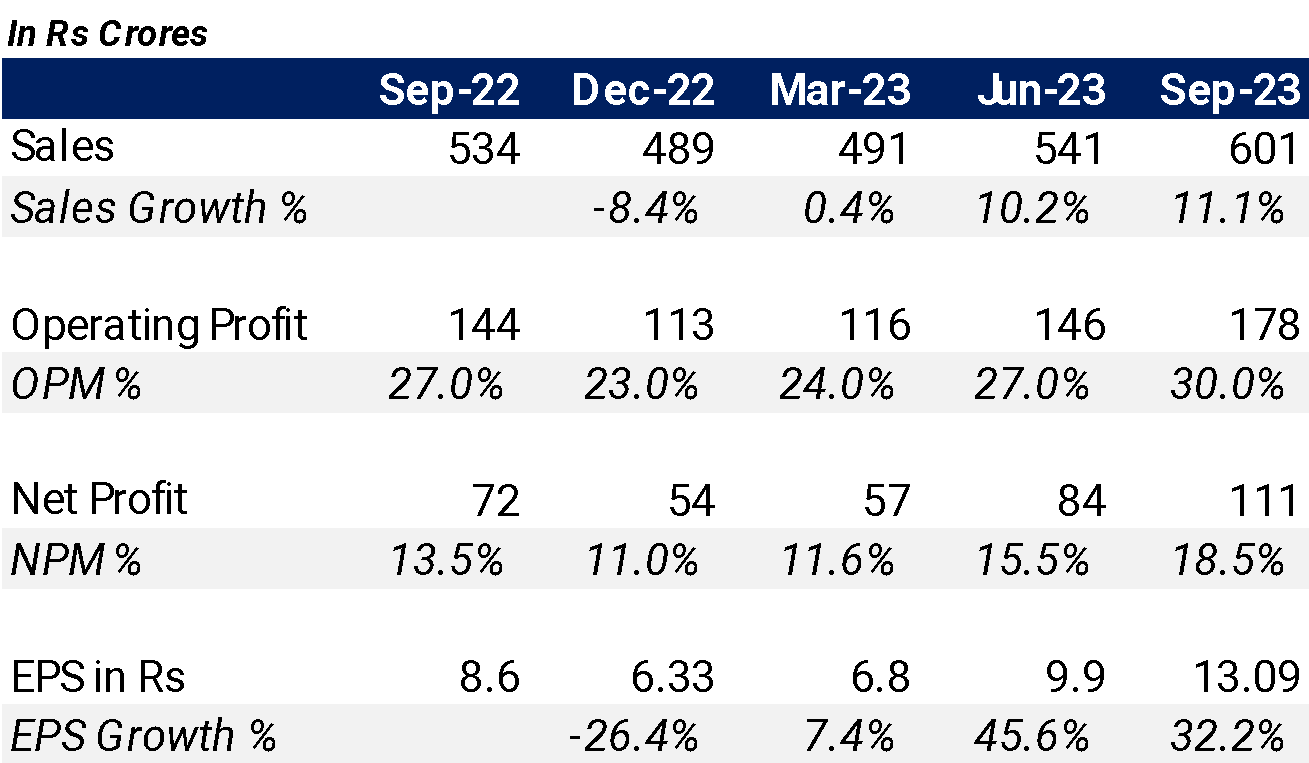

Dr Lal PathLabs Ltd

Dr. Lal PathLabs Limited stands as a prominent consumer healthcare brand in diagnostic services within India. With an integrated nationwide network, the company provides a comprehensive array of diagnostic and related healthcare tests and services. These services cater to core testing, patient diagnosis, and contribute to the prevention, monitoring, and treatment of various diseases and health conditions. Dr. Lal PathLabs serves individual patients, hospitals, healthcare providers, and corporate entities, reflecting a commitment to enhancing healthcare outcomes across diverse segments.

Performance

Crucial Allocations in Healthcare Budget

- PMSSY Upgrade: Rs. 3,365 crore (US$ 0.41 billion) Elevating tertiary healthcare infrastructure nationwide, this allocation fortifies institutions, enhancing their capacity for superior healthcare services.

- Human Resources Development: Rs. 6,500 crore (US$ 780 million) Focused on healthcare human capital, this funding drives professional training and fortifies medical education institutions, addressing the escalating demand for skilled healthcare professionals.

- National Health Mission (NHM): Rs. 29,085 crore (US$ 3.51 billion) The flagship NHM program receives a boost to advance healthcare access in rural areas, emphasizing maternal and child health, communicable disease control, and non-communicable disease prevention.

- AB-PMJAY Expansion: Rs. 7,200 crore (US$ 870 million) Nurturing the world’s largest health insurance scheme, this allocation ensures the sustained reach and growth of AB-PMJAY, providing free healthcare services to over 500 million Indians.

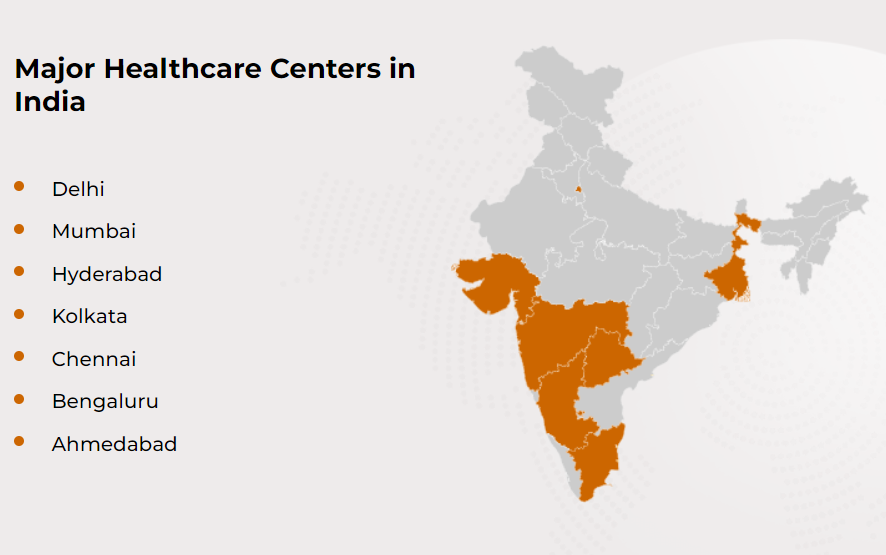

Major Healthcare Centres in India

Source: IBEF

In conclusion, healthcare and diagnostic industry, hinges on economies of scale with cost-efficient processing. Established players are poised for sustained growth, boasting experience, brand trust, global standards, diverse test menus, and expansion capabilities. The potential for industry consolidation, robust financials, and shifting healthcare perspectives post-COVID-19 drive optimism, offering attractive long-term prospects for listed companies.