If you’re drawn to stock investing, you’ve likely encountered stories of people making enormous wealth in the market. They can be captivating and spark your interest in exploring the world of stocks yourself. But along with these success stories come a host of myths that can cloud your judgment and mislead you as you navigate the stock market. In this blog, we will share five of the most common stock investing myths and show you how to debunk them. Whether you’re a beginner or a seasoned investor, understanding these myths is crucial to making smart investment decisions.

Myth 1: All-Time Highs Signal It’s Time to Sell

This myth suggests that when a stock hits an all-time high, it’s a sign to cash out. The reasoning behind this belief is that a stock at its peak is bound to come down. However, this isn’t always true. What’s more important is understanding why the stock price has reached that level.

Take the case of Trent Ltd. The company’s stock soared over 150% from March 2020 to March 2021. A typical reaction would be to sell and book profits, assuming it can’t go much higher. Yet, if you had done that, you would have missed out on further gains. The stock has since crossed Rs 4,000, marking an incredible return of over 1,000% from its March 2020 low.

So, how should you approach all-time highs? Instead of focusing solely on the price, consider whether the rise is justified by the company’s fundamentals—like earnings growth and a strong market position. If the underlying business is sound, there’s potential for further growth, even if the stock is at its peak.

Myth 2: Stock Investing Requires a Lot of Money

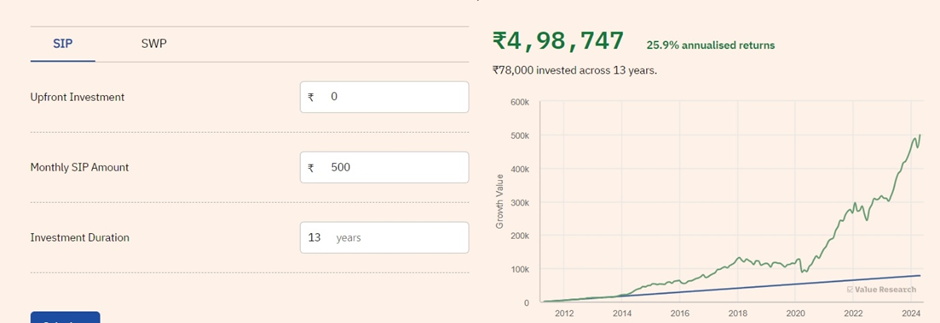

A common myth is that you need a significant amount of capital to start investing in stocks. This misconception can deter many potential investors. However, you can start investing with as little as Rs 100 or Rs 500. Remember, “Mutual Fund Sahi Hai”? The key to successful investing is consistency. Even with a modest investment, if you contribute regularly and stay invested over time, you can build a significant portfolio. By debunking this myth, you open the door to a wider range of investors, regardless of their financial situation.

The takeaway is that slow and steady wins the race. Here’s an example: if you had invested just Rs 500 per month in the Nippon India Small Cap Fund, your investment would have grown to Rs 4.98 lakhs over 13 years, with an annualized return of 25.9%.

Myth 3: All-Time Lows Mean It’s Time to Buy

A common misconception among investors is that when a stock hits an all-time low (ATL), it’s a great opportunity to buy. The thinking goes something like this: “How much lower could it possibly get?” However, there’s a harsh reality behind this question—stocks can go all the way to zero.

Stock prices often reflect a company’s performance and growth prospects. When a company’s fundamentals are weak, and it has poor management with no clear path to recovery, buying at a low price can be a trap. As legendary investor Peter Lynch once explained, the stock market isn’t just dark before dawn; it’s also dark before it becomes pitch black—meaning a stock’s value can crash completely.

Read: Decoding Peter Lynch’s Investment Mastery

A perfect example is when a stock priced at Rs 250 seems like a bargain, then drops to Rs 100, looking even more tempting, only to crash to single-digit territory. You can’t always predict where the bottom is, so buying a stock just because it’s cheap can be a risky move.

Instead, focus on the company’s fundamentals. A low stock price could signal deeper issues, so do your research before jumping in.

Myth 4: Large Companies Can’t Grow Further

Some investors avoid large companies because they believe these giants have already hit their peak and can’t grow much more. They think that only small companies have the potential for exponential growth. But this assumption isn’t entirely accurate.

Large companies often achieve economies of scale, reducing costs and gaining greater bargaining power with suppliers. They can also fend off competition more effectively. Additionally, large companies might be expanding into new markets or diversifying their product lines, creating fresh growth opportunities.

A prime example is Reliance Industries. Once primarily an oil and chemical conglomerate, it has since expanded into various sectors like fashion, FMCG, telecommunications, eCommerce, and even green energy. This diversification has allowed the company to continue growing despite its size.

As an investor, check if a large company is pursuing strategic mergers and acquisitions, investing in R&D, or expanding its geographical reach. If the answer is yes, then it’s likely that this large, slow-moving behemoth still has plenty of room to grow. Patience can be rewarding when it comes to big companies with a solid growth strategy.

Myth 5: Past Returns Guarantee Future Returns

This myth is a classic trap. Many investors look at a stock’s or mutual fund’s past performance and assume it will continue to deliver similar returns in the future. It’s tempting to think that a stock that has done well will keep doing well, but past returns are not a reliable indicator of future success.

This misconception is often rooted in what’s known as “recency bias.” We tend to believe that recent trends will persist, leading us to overlook the broader picture. Investors frequently search for “Best Performing Mutual Funds” or “Top Stocks to Invest in 2024,” but these lists often emphasize past performance, which doesn’t always predict future results.

The truth is that market conditions, company management, and industry trends can change rapidly. Just because something was successful in the past doesn’t mean it’ll work in the future. The best approach is to focus on a company’s fundamentals, industry trends, and overall economic conditions. This holistic view will give you a more accurate picture of a stock’s potential, rather than relying solely on its past returns.

Final Thoughts

Investing in stocks can be a fantastic way to build wealth, but it’s crucial to separate fact from fiction. By debunking these common myths, you can make smarter investment decisions and avoid costly pitfalls. Remember, it’s not about following the crowd or chasing the latest trends—it’s about doing your research, understanding the fundamentals, and staying patient.