What is an IPO?

IPO is the short form for the Initial Public Offering. It is a sale of shares by a company to the public for the first time. Without an IPO a company remains a privately held company. The privately held company have a small number of shareholders. These shareholders may range from promoters, who are the owners of the company, to their family members, friends, and relatives. Some strategic or professional investors may also hold the shares of a private company like venture capitalists, angel investors or private equity investors.

However, after the IPO process which informally is also known as going public, the number of shareholders increases multifold, when compared to the privately held company. IPO allows individuals like you and me and institutional investors to purchase and sell shares of the company. With this initial offering, a company’s share becomes eligible for a stock exchange listing. Stock exchange listing facilitates in buying and selling of such shares of companies.

History of the Indian IPO market

The Indian equity market’s history of Initial Public Offerings (IPOs) is a captivating narrative of the country’s financial evolution. While the concept of IPOs is not new, the Indian IPO market has undergone a remarkable transformation in recent decades.

In 1977, Reliance Textile Industries’ IPO created history by introducing the equity cult in India. The issue was oversubscribed seven times, strengthening Reliance’s growth ambitions. It got listed on BSE on January 23, 1978. The Reliance IPO established a never-before-seen trend in the Indian capital market. It was the first time that a large private company had gone public in India. The IPO also attracted a large number of retail investors, which helped to broaden the base of the Indian stock market.

In 1977, Reliance Textile Industries’ IPO created history by introducing the equity cult in India. The issue was oversubscribed seven times, strengthening Reliance’s growth ambitions. It got listed on BSE on January 23, 1978. The Reliance IPO established a never-before-seen trend in the Indian capital market. It was the first time that a large private company had gone public in India. The IPO also attracted a large number of retail investors, which helped to broaden the base of the Indian stock market.

Source: www.ril.com

The establishment of the Securities and Exchange Board of India (SEBI) in 1988 was a watershed moment in the development of the Indian IPO market. SEBI’s focus on transparency and investor protection has played a pivotal role in enhancing the credibility and integrity of the IPO process.

The 1992 Harshad Mehta securities scam, while exposing vulnerabilities in the IPO system, also led to important reforms and automation of trading systems.

The dot-com boom and the rise of the IT sector in the late 1990s witnessed a flurry of IPOs, with many companies raising record amounts of capital. Over the years, SEBI has continued to introduce regulatory changes to streamline the IPO process and safeguard investor interests. Digital transformation has also revolutionized the IPO landscape, making it more efficient and accessible.

Today, the Indian IPO market is a vibrant and dynamic ecosystem, attracting diverse companies from a wide range of sectors. The market’s maturity is reflected in the increasing sophistication of IPO investors and the growing participation of institutional investors.

Historical IPO Listing Timelines in India

Prior to 2000, the IPO listing process in India was relatively time-consuming and could take up to 60 days. This was due to a number of factors, including manual processing of applications, delays in clearing payments, and physical issuance of share certificates.

In order to streamline the IPO listing process and make it more efficient, SEBI introduced a number of reforms over the years. These reforms included:

- Dematerialization of shares: In 1996, SEBI introduced the dematerialization of shares, which eliminated the need for physical share certificates. This significantly reduced the time required to settle IPO transactions.

- Electronic IPO processing: In 1999, SEBI introduced electronic IPO processing, which further automated the IPO listing process.

- T+6 listing: In 2000, SEBI introduced the T+6 listing timeline, which required companies to list their shares on the stock exchange within 6 days of the IPO closing date.

In August 2023, SEBI further reduced the IPO listing timeline to T+3 days, making it one of the fastest IPO listing timelines in the world. One recent example is RR Kabel which was listed on September 20, 2023.

The Indian IPO market has come a long way since its humble origins. It has played a critical role in mobilizing capital to support the country’s economic growth and development.

As the Indian economy continues to mature and evolve, the IPO market is poised to play an even more significant role in channeling capital to the most promising businesses.

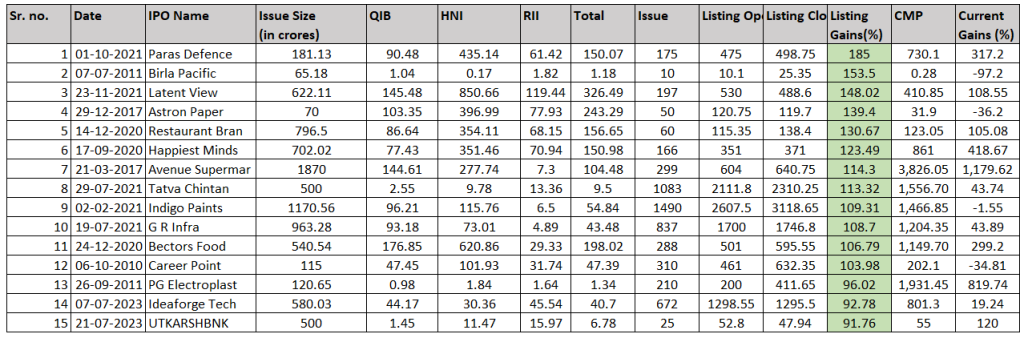

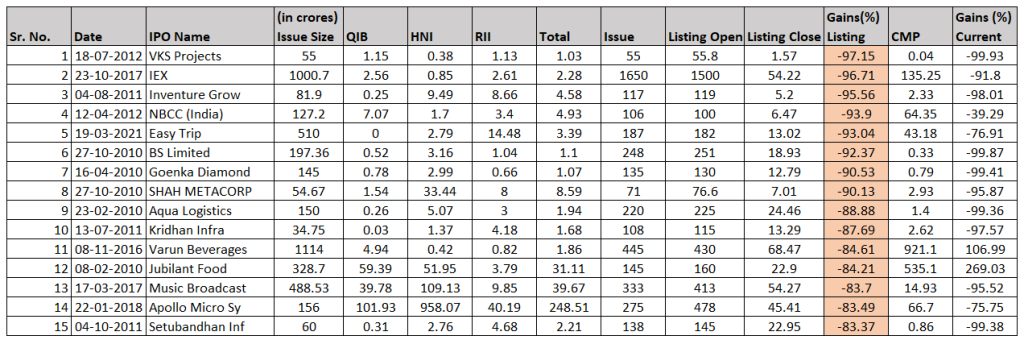

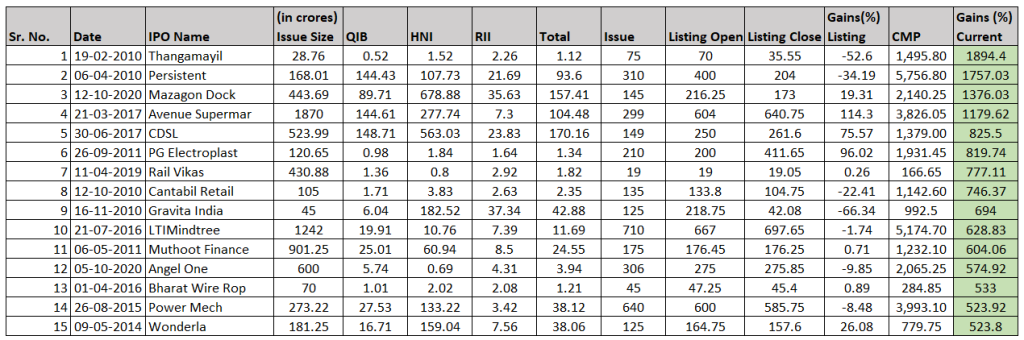

Here are the top 15 companies in terms of listing gains :

- Gainers

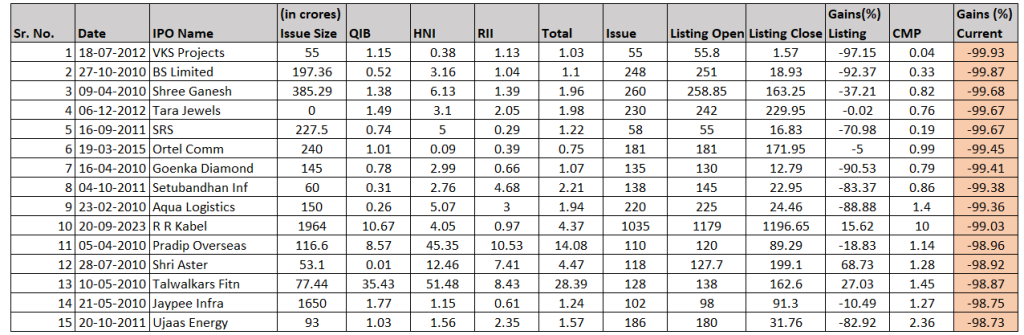

- Losers

Here are the top 15 companies in terms of current gains since listing:

- Gainers

- Losers

The following data tells us about how IPOs have performed on average:

| Avg IPO listing gains (2010-2023) | 3.56% |

| Avg IPO current gains (2010-2023) | 72.33% |

Year-wise breakup:

| Avg 2023 IPO listing gains | 22.24% |

| Avg 2022 IPO listing gains | 11.90% |

| Avg 2021 IPO listing gains | 19.60% |

| Avg 2020 IPO listing gains | 51.97% |

| Avg 2019 IPO listing gains | 0.54% |

| Avg 2018 IPO listing gains | -2.62% |

| Avg 2017 IPO listing gains | -1.26% |

| Avg 2016 IPO listing gains | 1% |

What’s Next

In the global landscape, India has emerged as the frontrunner in Q1 2023, securing the top position for the number of Initial Public Offerings (IPOs). This reflects a robust IPO market in the country, even though it’s primarily driven by smaller IPOs. Notably, there has been a 33% increase in the total number of IPOs in Q1 2023 compared to the same period in 2022. While the total proceeds from main market IPOs witnessed an 89% decline, the number of deals increased by 33%. The SME segment, on the other hand, showed remarkable resilience, with a 123% increase in proceeds raised and a 23% increase in the number of deals. This underscores the dynamism of the Indian IPO market.

Know: Mainboard IPO Vs SME IPO

Despite ongoing global uncertainties and relatively smaller issue sizes, the Indian IPO market displayed resilience and growth in Q1 2023. The largest IPO in terms of proceeds during this period was by Divgi TorqTransfer Systems Pvt Ltd, raising approx. Rs. 416 crore. Moreover, there is a promising IPO pipeline for H2 2023 and beyond, with around 15 companies filing their Draft Red Herring Prospectuses (DRHPs) in Q1 2023. These prospective IPOs span diverse sectors, indicating a positive outlook for the Indian IPO market

Check: Understanding RHP and DRHP

While India’s IPO activity may have been subdued recently, companies are diligently preparing for potential IPO launches in the near future. As the Indian economy continues to showcase its growth potential, the IPO momentum is expected to gain traction. These developments, alongside regulatory enhancements, are set to fortify the Indian capital markets and establish a solid framework for future IPO activities. Consequently, the IPO market is anticipated to rebound.

This shift in the IPO landscape mirrors the evolution of the Indian equity market, which has come a long way since its inception. It underlines the nation’s economic potential and its resilience in the face of global challenges. With the surge in IPO activity and the diversification of sectors, India remains a bright spot in the global economic arena.

In conclusion, the journey of Initial Public Offerings (IPOs) in the Indian equity market is a testament to the nation’s financial evolution. From its early days as a relatively small and less regulated market to becoming a vibrant and dynamic ecosystem, the Indian IPO market has come a long way. The establishment of SEBI in 1988 marked a turning point, ensuring transparency and investor protection. Today, the market stands as a symbol of maturity, attracting diverse companies from various sectors. As India’s economy continues to grow and evolve, the IPO market is poised to play an even more significant role in channelling capital to promising businesses and offering opportunities for investors.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.