In the world of mutual fund investments, Systematic Investment Plans (SIPs) have emerged as a popular choice, offering the benefits of disciplined investing and rupee-cost averaging. However, as the popularity of SIPs grows, so does the debate about the ideal frequency of daily, weekly, or monthly. Are more frequent SIPs really the key to maximizing returns, or does simplicity reign supreme?

Monthly SIPs

For many, the simplicity of monthly SIPs aligns seamlessly with long-term investment goals. Investing a fixed amount once a month has proven effective, allowing investors to accumulate wealth steadily over the years. The historical data indicates that monthly SIPs have stood the test of time, providing consistent returns.

Read: Simplifying Systematic Investment Plan

Daily and Weekly SIPs

While the allure of capturing sharp market movements may tempt some towards daily or weekly SIPs, the practicality and impact on returns come under scrutiny. Daily SIPs, for instance, can be cumbersome to manage and track, especially when it comes to tax implications during redemption.

In the event of significant market corrections, the argument for daily SIPs gains traction. However, the counterargument suggests that such corrections are better navigated through strategic lump-sum investments supplementing regular SIPs.

Analysing the Returns

Which is a good frequency for SIPs – Daily, Weekly or Monthly?

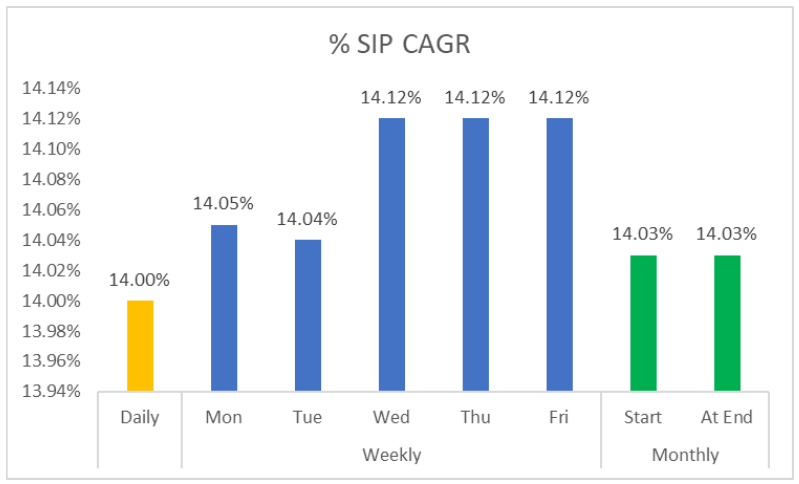

Whether doing SIPs at shorter frequencies/intervals will boost returns?

SIP at Different Frequencies in Sensex for 20 Years (Jan 2004 till Dec 2023)

| SIP Frequency |

Daily |

Weekly |

Monthly |

|||||

| Mon | Tue | Wed | Thu | Fri | Start | At End | ||

| SIP Amount | 500 | 2380 | 2380 | 2380 | 2380 | 2380 | 10335 | 10355 |

| Total Amt Invested (in Lakhs) | 24.825 | 24.823 | 24.823 | 24.823 | 24.847 | 24.847 | 24.85 | 24.85 |

| Value (in Crs) | 1.215 | 1.215 | 1.214 | 1.224 | 1.228 | 1.227 | 1.219 | 1.208 |

| % SIP CAGR | 14.00% | 14.05% | 14.04% | 14.12% | 14.12% | 14.12% | 14.03% | 14.03% |

Complications and Tax Implications

The complications associated with daily and weekly SIPs further dampen their appeal. Most investment platforms are geared towards monthly SIPs, leaving the onus on the investor to remember and execute more frequent transactions. Recordkeeping becomes a daunting task, with an increase in entries and the potential for taxation complexities.

Weekly SIPs Stand Strong

The data speaks volumes weekly on Wednesday, Thursday and Friday’s SIPs offer comparatively high returns without the added complexities. The convenience, aligning with most individuals’ weekly income cycles, makes them a practical choice. While the option for daily or monthly SIPs exists, the consensus leans towards the simplicity and effectiveness of weekly investments.

In systematic investing, discipline is more important than frequency!

Which is better: Mutual Fund SIP vs Stock SIP

Enhancing Returns through Discipline

Ultimately, the focus should not be on the frequency of SIPs but on investing a consistent and suitable amount for the long term. Discipline, coupled with avoiding common SIP mistakes, remains the key to enhancing returns.

In conclusion, the debate over SIP frequency might just be a distraction from the core principles of disciplined and strategic investing. Whether you choose daily, weekly, or monthly SIPs, the real measure of success lies in your commitment to a well-thought-out investment plan.

Know what to do when – Running out of Funds – Pause or Stop SIP?