Eicher Motors is a leading player in the Indian automobile industry, with a strong market share in both motorcycles and commercial vehicles. As of June 2023, the company has a market share of:

- 24.70% in the bus segment

- 8.50% in the heavy-duty commercial vehicles segment

- 36.90% in the light and medium-duty commercial vehicles segment

- 90.00% in the mid-segment motorcycle 250cc-750cc (Royal Enfield) segment

This success is a testament to the company’s transformation over the years. In the post-colonial era, Eicher Motors was a modest family business importing tractors. However, for nearly four decades, it remained content with being “good enough.” In 1995, Eicher acquired Enfield Motorcycles, a British motorcycle brand with a rich history but a troubled financial situation.

How did Lal strike a balance between modernizing the product and retaining the brand’s iconic identity?

The iconic Bullet motorbike manufacturer was facing several challenges in the early 2000s. Demand was low with sales barely crossing 2,000 units a month against the production capacity of 6,000. Reliability issues such as engine seizures, oil leakages and electrical failures were rampant and the bike was increasingly being seen as too difficult to manage. Also, emerging emissions and other regulatory norms raised questions about the future of the bikes. The Eicher Motors management did not see value in the bikes.

Siddhartha Lal, the third-generation heir to the Eicher Empire, had a different vision for Royal Enfield. He believed that the company could be revived by modernizing the product and attracting new buyers.

He holds a Master’s degree in Automotive Engineering from the University of Leeds and is a Cranfield University-qualified mechanical engineer. Siddhartha is also an Economics graduate from St. Stephens College in Delhi and an alumnus of The Doon School.

Siddhartha took over as CEO in 2006 and initiated a major turnaround of the company. He began by divesting all non-core businesses, keeping only the motorcycle (Royal Enfield) and truck divisions. He then focused on revamping Royal Enfield, which was struggling with outdated technology and reliability issues.

Lal carefully considered the needs and wants of both existing and potential customers. He understood that the core appeal of Royal Enfield bikes was their classic design, thumping exhaust note, and low torque. He therefore retained these features while making necessary changes to improve reliability and performance.

In 2010, Eicher launched the Royal Enfield Classic, a game-changer for the company. It preserved the look and feel of older generation bikes but incorporated new technology, engines, and transmission with improved reliability. The Classic was a huge success, and Royal Enfield sales took off.

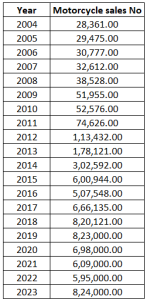

Motorcycle vehicle sales volume saw a growth from 28,361 in 2003-2004 to 824,000 in 2023-2024 which is 18.35% CAGR over 20 years:

From Bikes to Trucks

After turning around Royal Enfield, Siddhartha Lal turned his attention to trucks in 2006. The group was ambitious to challenge the No. 1 player in the Indian truck market, despite lacking the financial muscle, technology, and distribution. Lal struck an alliance with Volvo, which also brought in equity.

While Lal chose to revive and create a strong brand on his own in the motorcycle business, he did the opposite when it came to Eicher’s truck business. He realized that Eicher was only a segment player in the 5-15 tonne category, in a market dominated by Tata Motors and Ashok Leyland. Moreover, many multinational companies such as Daimler, Scania, and Mann had announced plans for India. To face emerging competition and to take advantage of future growth, Eicher Motors needed capital, technical capability, and reach.

In Volvo, Eicher found such a partner, and Volvo Eicher Commercial Vehicles Ltd (VECV) was set up in 2008 with a 46:54 shareholding, with Eicher holding the majority. Lal believed that it was better to have a smaller share of a larger pie, rather than the whole of a small pie.

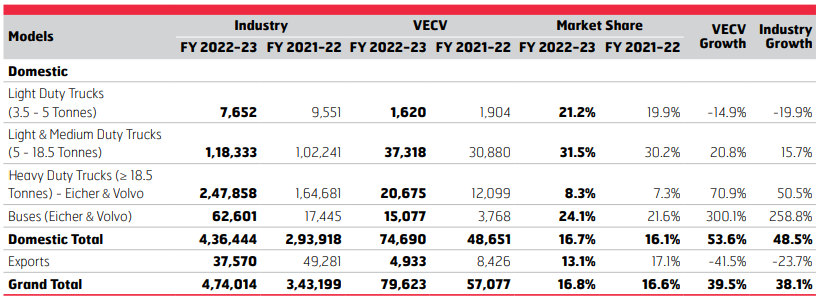

Volvo and Eicher have complementary strengths. Volvo has world-class technology and processes, while Eicher has frugal methods of product development. The VECV volume saw a consistent growth from 24,000 units in 2008 to 79,623 units in 2023.

- Recent Financial Results

Eicher Motors has posted record-breaking results for the first quarter of FY 2023-24, with revenue from operations growing by 17.3% to Rs 3,986 crore, EBITDA growing by 22.8% to Rs. 1,021 crores, and profit after tax (PAT) growing by 50.4% to Rs. 918 crores. This is the best-ever Q1 performance for the company and is also the fourth consecutive quarter of the highest ever Revenue from operations and PAT.

The company’s motorcycle division, Royal Enfield, sold 2,25,368 (consolidated) motorcycles in the quarter, an increase of 21.1% from 1,86,032 (consolidated) motorcycles sold over the same period in FY 2022-23. VECV division sold 19,551 units in this quarter.

At VE Commercial Vehicles, the company registered the highest ever sales and revenue for Q1 and made strong market-share gains in both – Light Medium duty and Heavy-duty trucks. Overall, the company is on a solid growth path and has a resolute focus on the long-term strategic business objectives.

- About Company and Stock Price:

Siddhartha Lal’s visionary leadership and operational acumen transformed Eicher Motors into a financial juggernaut, reversing the company’s fortunes. The stock became a 100-bagger, with its price skyrocketing from Rs 30 to Rs 3,500 under his stewardship.

| Year | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 |

| Sales | 6,173 | 7,033 | 8,965 | 9,797 | 9,154 | 8,720 | 10,298 | 14,442 |

| Expenses | 4,484 | 4,859 | 6,156 | 6,893 | 6,971 | 6,937 | 8,120 | 10,996 |

| Operating Profit | 1,690 | 2,174 | 2,809 | 2,904 | 2,183 | 1,783 | 2,178 | 3,446 |

| OPM | 27.38% | 30.91% | 31.33% | 29.64% | 23.85% | 20.45% | 21.15% | 23.86% |

| Other Income | 326 | 416 | 536 | 701 | 572 | 482 | 496 | 908 |

| Interest | 2 | 4 | 5 | 7 | 19 | 16 | 19 | 28 |

| Depreciation | 137 | 154 | 223 | 300 | 382 | 451 | 452 | 526 |

| Profit before tax | 1,877 | 2,433 | 3,116 | 3,297 | 2,355 | 1,798 | 2,203 | 3,800 |

| Tax % | 29% | 30% | 30% | 33% | 22% | 25% | 24% | 23% |

| Net Profit | 1,338 | 1,667 | 1,960 | 2,203 | 1,827 | 1,347 | 1,677 | 2,914 |

| EPS in Rs | 49.27 | 61.27 | 71.89 | 80.75 | 66.91 | 49.28 | 61.32 | 106.55 |

|

CAGR (2016-2023)

|

Sales | EBITDA | PBT | PAT |

| 8.87% | 7.38% | 7.31% | 8.09% |

The turnaround of Eicher Motors is a remarkable business case study demonstrating the significance of visionary and bold leadership in transforming a company’s fortunes. Siddhartha Lal’s audacious decisions and unwavering focus on execution have propelled the company to become a leading motorcycle manufacturer and a formidable player in the commercial vehicle segment. This emphasizes how crucial it is to have a good management who can turn around the story of a company.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.