From the first sprout of facial hair to the seasoned beard, Gillette razors have been your trusted companion in every Indian home, sculpting confidence, one smooth stroke at a time.

Gillette India Ltd, a subsidiary of Procter & Gamble Hygiene and Health Care, is a prominent player in the personal grooming and oral care product industry. With a diverse product portfolio encompassing razors and cartridges, toothbrushes, blades, shaving brushes, shaving foams and gels, oral care products, and skin care products, Gillette caters to both men and women. In this analysis, we delve deeper into the company’s financial performance, market positioning, and strategic outlook to provide valuable insights for investors and stakeholders alike.

Success Through Premiumization

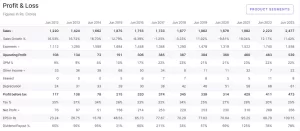

Shaving industry giant Gillette has achieved remarkable double-digit growth rates, boasting a 12% surge in its top line (TL) and a remarkable 36% boost in its bottom line (BL). The catalyst behind this impressive performance can be attributed to the strategic shift towards premiumization of their product offerings. In a strategic pivot that commenced post-2014, Gillette transitioned from merely being a player in the wet shaving business to a comprehensive grooming solutions provider. This transformation, which has elevated the brand into a new era of prosperity, has mainly unfolded across two primary segments: grooming and oral healthcare.

Premium Touch Amidst Steady Industry Growth

While the grooming industry has recently experienced a slowdown, with a modest growth rate of 4%-5%, Gillette India has defied industry norms with its robust double-digit growth. This exceptional performance is chiefly a result of the brand’s unwavering commitment to premiumization, elevating grooming rituals to a luxurious experience. Gillette’s offerings have not only adapted to consumer preferences but have, in fact, set the bar higher, creating a path to sustainable growth.

Oral Healthcare’s Remarkable Turnaround

In parallel, Gillette’s foray into the oral healthcare business has witnessed a remarkable turnaround. Initially operating at a loss, the division has now achieved profitability, boasting a healthy 13% margin. This success is a testament to Gillette’s ability to revitalize struggling segments through strategic management and product innovation, delivering value not only to shareholders but also to consumers seeking superior oral care solutions.

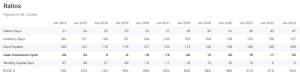

Gillette India (Cash Conversion Cycle)

In addition to these achievements, Gillette’s nimble management approach, reflected in its negative cash conversion cycle and strategic advertising investments, positions the company for continued growth. With advertising expenses accounting for approximately 10% of sales, the company remains adaptable to evolving market dynamics. Gillette’s management stands ready to navigate the path ahead, adjusting ad spend as necessary to drive future business success.

Management commentary on ad spend

Let’s examine the valuation of the stock in relation to its industry peers, assessing whether it carries a premium or discount in the market.

The current Price-to-Earnings (PE) multiple stands at approximately 56, while the median PE over the past five years hovers at 66. Despite the company posting its highest-ever Earnings Per Share (EPS), it appears that the market hasn’t fully acknowledged the stock’s true potential. With a growing per-capita income, a larger segment of consumers is gravitating towards premium products, signalling untapped growth potential that the market has yet to fully appreciate.

In comparison to its industry peers, which have witnessed bullish trends, the best-case scenario suggests a PE multiple in the range of 80-85. Conversely, the worst-case scenario could see the PE dip to approximately 45-50. This evaluation underscores the intriguing dynamics at play in the market, where the stock’s intrinsic value may be poised for a significant re-evaluation.

Investing in the Cutting Edge: Gillette’s place in the Razor and Trimmer Market

Razor :

While Gillette and Bombay Shaving are often regarded as competitors in the grooming industry, a closer examination of their respective razor product lines reveals a notable disparity in consumer preference. Specifically, when comparing similar-range razors, it becomes evident that Gillette has garnered over a thousand purchases, while Bombay Shaving trails behind with just slightly over 50 purchases. This observation underscores the significant gap in consumer favourability between the two brands within this specific product category. The premium category is dominated by Gillette India.

Trimmers :

In the competitive landscape of trimmers, three notable contenders emerge: Mi with over 80,000 reviews averaging 4 stars, Philips with over 60,000 reviews and a similar average rating, and Gillette with over 1,500 reviews maintaining an average of 4 stars. Surprisingly, Mi, despite offering a pricier product, outperforms its rivals with greater consumer satisfaction. This insight highlights a prevailing trend in the trimmer market—consumers prioritize value over price. Leveraging its renowned brand, Gillette has a promising opportunity to enhance their trimmer offerings to align with the value-conscious consumer mindset, potentially boosting trimmer sales volume considerably.

Conducting a Side-by-Side Review Analysis: Trimmer Category

Gillette Philips

An intriguing contrast emerges when we delve into consumer ratings. Gillette, with 17% of its ratings at just 1 star, based on a relatively modest review count of 1,658, faces a more challenging scenario compared to Philips. Philips, with a significantly larger pool of reviews at 61,768, maintains a lower 10% 1-star rating. This stark contrast underscores the superior consumer experience associated with Philips, indicating that Gillette may encounter formidable obstacles in its quest to gain substantial market share.

Competitors (D2C)

Management Commentary on Competitors:

The management’s articulated perspective places a significant emphasis on prioritizing consumer satisfaction over competing head-to-head, signalling a commendable approach. This strategic mindset implies a potential thesis: a concerted effort to cultivate a growing base of loyal customers. This, in turn, has the potential to amplify sales volume, elevating the company’s overall value in the market and positioning it favourably against competitors.

Growth Prospects:

P&G, the parent company, has notably expressed its optimism about the vast growth potential within its Indian subsidiaries. India is poised to emerge as a paramount contributor to both top-line and bottom-line results on a global scale. Speculating ahead, the prospect of a potential merger between P&G’s Indian subsidiaries, operating within similar industries, and Gillette could unlock a synergy-driven game plan. Such a strategic alignment holds the promise of expanding profit margins, further enhancing the company’s competitive edge.

Potential downside risks for Gillette:

Firstly, the company may face challenges if raw material prices continue their upward trajectory, as indicated by the management’s cautionary note about the absence of imminent relief. Secondly, the success of Gillette’s premiumization strategy is pivotal; failure to achieve double-digit sales growth could result in stagnant returns. Thirdly, the emergence of nimble competitors like Beardo and Bombay Shaving, armed with creative advertising campaigns, may lead to potential price wars that could impact Gillette’s bottom line. Lastly, the ‘Parent Company Effect’ looms as a risk factor—any adverse developments at P&G could cast a shadow on Gillette, even if the latter is performing well independently.

Strategic Collaboration:

In summary, the Price-to-Earnings (PE) ratio stands at a favourable 56, well below the mean, while the company has achieved its highest-ever Earnings Per Share (EPS) post-pandemic. Additionally, P&G, the parent company, is actively pursuing an aggressive expansion strategy. As India’s per capita GDP continues to rise, the premiumization trend holds significant potential, potentially paving the way for double-digit margins. Gillette’s strategic collaborations with influential figures such as Bugatti, Son, Sachin Tendulkar, Shreyas Iyer, Shubhman Gill, and Roger Federer further enhance the product’s external appeal, positioning the company for a bright future.

In summary, the Price-to-Earnings (PE) ratio stands at a favourable 56, well below the mean, while the company has achieved its highest-ever Earnings Per Share (EPS) post-pandemic. Additionally, P&G, the parent company, is actively pursuing an aggressive expansion strategy. As India’s per capita GDP continues to rise, the premiumization trend holds significant potential, potentially paving the way for double-digit margins. Gillette’s strategic collaborations with influential figures such as Bugatti, Son, Sachin Tendulkar, Shreyas Iyer, Shubhman Gill, and Roger Federer further enhance the product’s external appeal, positioning the company for a bright future.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.