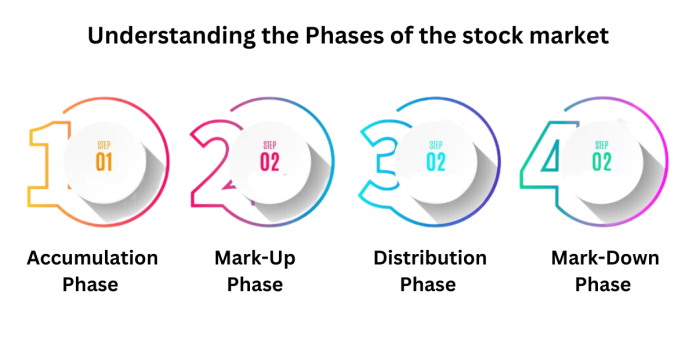

The Indian stock market, like any other financial market, experiences cyclical patterns that can significantly impact investor’s fortunes. Recognizing and understanding these market cycles is crucial for investors seeking to navigate the dynamic landscape of the stock market in India. In this article, we will explore the four key phases of a market cycle and how investors can leverage this knowledge to make informed decisions.

Accumulation Phase

Just as in any market cycle, the Indian stock market begins with an accumulation phase. This period usually follows a market bottom, where shrewd investors, including corporate insiders and value investors, start to accumulate stocks at attractive valuations. During this phase, general market sentiment remains bearish, with media headlines often predicting doom and gloom. Savvy investors take advantage of the pessimism, picking up stocks at a discount while the broader market sentiment shifts from negative to neutral.

Investors should keep an eye on valuations and overall market sentiment during the accumulation phase to identify potential buying opportunities.

Mark-Up Phase

As the market stabilizes and starts moving higher, the markup phase sets in. The early majority, including smart money managers and experienced traders, joined the rally, recognizing the changing market sentiment and direction. Media reports may suggest that the worst is over, but caution is essential as valuations climb beyond historic norms. This phase witnessed a surge in market volumes, with the late majority entering the market driven by fear of missing out (FOMO).

During this euphoric phase, investors should exercise caution and remain mindful of the possibility of a market reversal. The late majority often enters the market when insiders and smart money start offloading their holdings.

Distribution Phase

The distribution phase signals a shift in sentiment, as sellers begin to dominate. Bullish sentiment from the markup phase turns mixed, and prices may consolidate within a trading range for weeks or months. This emotional period is marked by fear, hope, and occasional greed, as investors grapple with the decision to hold or sell.

Indian investors need to pay attention to classic chart patterns like double tops, triple tops, and head and shoulders formations during the distribution phase. This phase can be a challenging time for those holding positions, as valuations may be extreme, and a market reversal becomes increasingly likely.

Mark-Down Phase

The mark-down phase is really tough for investors who still have their money in the market. Some people hold on, wishing the value of their investments will go back up. But as prices keep dropping, a lot of them eventually give up. This phase is like a signal for smart investors who go against the crowd. It indicates that the market might be at its lowest point.

For investors, noticing the mark-down phase is a chance to think about whether to sell stocks that are losing money. It’s also a time to get ready for the next accumulation phase, where new opportunities to make money may come up.

Understanding the phases of the market cycle is essential for investors in the stock market. By recognizing these patterns, investors can make informed decisions, maximize returns, and avoid getting caught off-guard during periods of market volatility. Whether in the accumulation, mark-up, distribution, or mark-down phase, staying vigilant and adapting investment strategies accordingly will help investors navigate the ever-changing landscape of the Indian stock market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.