The Indian IT industry has been a hotbed of innovation and growth for decades, attracting investors from around the globe. As we gear up for the upcoming earnings season, it’s crucial to understand the historical performance of these IT giants. This historical context will provide valuable insights for investors and analysts looking to make informed decisions in the fast-paced world of technology investments.

Significance in the global IT landscape

India has emerged as a powerhouse in the global IT and BPO services arena, with a workforce of 5 million skilled professionals. Over the last two decades, the nation’s service exports have surged by an impressive 14%. As we look to the future, India is well-positioned to accelerate its growth in this sector, solidifying its role as a significant player on the global stage, and contributing significantly to the IT and BPO industry.

Decoding Stock Split and Bonuses

Stock splits and bonuses can have financial implications, they affect wealth in different ways. A stock split doesn’t change the total value of your investment but may affect trading dynamics, while a bonus directly increases your wealth but requires prudent financial management to have a lasting impact on your financial well-being.

Let’s delve into how Indian IT companies have utilized these strategies to enhance shareholder value.

| Company | Split History | Bonus Share History (times) |

| Wipro | 2 Splits (2:1 & 1:1) | 13 |

| Infosys | 1 Split (2:1) | 8 |

| TCS | No Splits | 3 |

| Nucleus Soft | No Splits | 3 |

| Cyient | 1 Split (2:1) | 3 |

| Mphasis | No Splits | 3 |

| HCL Tech | 1 Split (2:1) | 3 |

| Eclerx | No Splits | 3 |

| Birla Soft | 2 Splits (2:1 & 1:1) | 2 |

| Mastek | 1 Split (2:1) | 2 |

| Zensar | 1 Split (2:1) | 1 |

| Sonata Soft | 1 Split (2:1) | 1 |

| Persistent | No Splits | 1 |

| Coforge | No Splits | 1 |

| Oracle | No Splits | 1 |

| Tech Mahindra | 1 Split (2:1) | 1 |

| Tata Elxsi | No Splits | 1 |

| FSL | No Splits | No |

| L&T Tech | No Splits | No |

| LTIM | No Splits | No |

| Sasken | No Splits | No |

| Happiest Mind | No Splits | No |

Note: Stock split ratios are represented as “X: Y”, where X shares are issued for every Y share held.

Read: What Are Corporate Actions in Share Market

Observation

It’s interesting to note that while some companies have employed stock splits to make their shares more accessible, others have chosen not to split their stock. The decision often depends on the company’s growth trajectory, shareholder composition, and broader market dynamics.

Rational behind Stock Splits

Enhancing Liquidity: By increasing the number of shares, a stock split can make a company’s share more readily available for trading. This can lead to greater liquidity in the stock, making it easier for investors to buy and sell shares.

Attracting Retail Investors: Lowering the share price through a split can make the stock more affordable for retail investors, potentially broadening the shareholder base.

Psychological Impact: A lower stock price after a split can create a perception of affordability and attract more investors.

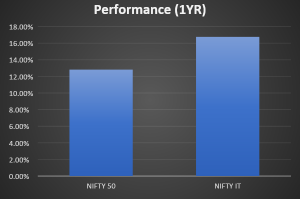

Performance of NIFTY IT and NIFTY 50 (1 YR)

In a recent research study, intriguing findings emerged regarding market performance. Bonus issues were associated with impressive abnormal returns of approximately 1.8%, while stock splits showed notable returns of around 0.8%. These numbers underscore the market’s response to these corporate actions, providing valuable insights for savvy investors.

Market Expectations:

Market expectations for tier 1 companies anticipate subdued revenues due to a weak macroeconomic environment. Factors include reduced discretionary spending, project delays, and yet-to-benefit cost-cutting measures. Big 3 secure large deals, but revenue conversion is slow. Notably, Infosys’s significant partnership expansion with Liberty Global, valued at 1.5 billion euros over five years (or 2.3 billion euros if extended to eight years), adds a positive note amid these challenges. Margin growth challenges persist with a stable Rupee.

In conclusion, the historical stock split and bonus data reveal the resilience and adaptability of Indian IT companies. As we approach the earnings season, these insights serve as valuable markers for investors. While challenges persist, India’s IT sector remains poised for continued growth, offering a compelling landscape for the informed investor.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.