About the company:

PCBL is currently trading at Rs 177.5 per share near its all-time high. The stock managed to break its 5-year high mark, Rs 159.4 on 01/07/2023. Phillips Carbon Black Limited (PCBL) is a leading carbon black manufacturer in India with a global presence. The company has over 60 years of experience in the carbon black industry and is now evolving into a prominent chemical manufacturer.

PCBL is the largest carbon black manufacturer in India and has a significant customer base in over 50 countries. The company’s product portfolio consists of a wide range of carbon black products, including rubber black products and specialty chemicals. The rubber black products are used in a variety of applications, including tires, conveyor belts, industrial hoses, food plates, electric wires, and camera bodies. The specialty chemicals are used in a variety of industries, including automotive, rubber, plastics, paints, and inks.

Apart from five strategically located state-of-the-art plants in India, PBCL has set up an R & D Centre at Palej (Gujarat) and an Innovation Centre at Ghislenghien (Belgium) to ensure that product portfolio and processes are always ahead of the curve.

Financial Performance

PCBL’s Q1FY24 financial performance was mixed, with revenue down 1.9% QoQ at Rs. 1,347.2 crore but PAT was up 6.9% QoQ at Rs 109.35 crore. The revenue drop was due to lower crude prices, but gross margins remained healthy around 30%. Working capital decreased due to lower crude and net debt came down roughly by Rs 50 crore.

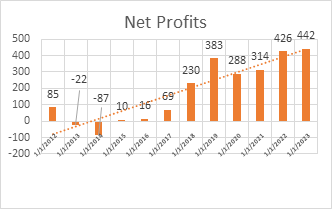

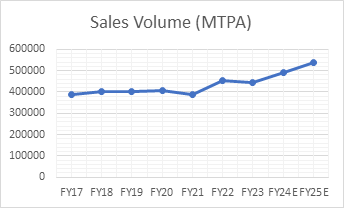

Overall, PCBL’s financial performance has been strong over the past 10 years, with revenue and net profit growing at healthy CAGRs 9.7%and 17.9% respectively. The company’s return ratios are decent, Its ROE stands at 15.7% which is around Industry average, PE of 15.93 which is well below the Industry PE. As far as volume growth is concerned the management expects about 10% to 12% kind of a volume growth this year over last year.

PCBL’s mid to long-term prospects:

- The global carbon black industry is undergoing a structural change, which is creating opportunities for Indian manufacturers. The changing cost structure in China, multinational companies adopting a China+ strategy, and sanctions on Russia are all contributing to this change.

- In China, manufacturers are facing significant cost pressure, which is making it less profitable to produce carbon black. As a result, there is likely to be further consolidation in the Chinese carbon black industry over the next five to six years. This will create opportunities for Indian manufacturers, as they will be able to export more carbon black to China.

- Russia has also been sanctioned by the West and the EU. As a result, Russian carbon black producers will not be able to add more capacity. Additionally, the increased logistic costs and discounted market price will make it difficult for them to make a margin in this business. This will further benefit Indian carbon black manufacturers.

PCBL’s specific opportunities:

- PCBL is the leading carbon black manufacturer in India and has a vast geographical footprint over 50 countries. The company is well-positioned to benefit from the opportunities mentioned above.

- PCBL is already increasing its capacity. After the commissioning of its Mundra plant, the company’s total speciality black capacity will stand at 92,000 tons. The company is also implementing one more line, which is expected to be operational by 2024.

- PCBL is also improving its production efficiency. The company’s Chennai facility is operating only at about 45% capacity utilization level against one line. However, two more lines are expected to be added in the current quarter. This will help the company to reduce its maintenance costs.

PCBL’s ongoing and future capex plans:

PCBL is currently implementing a number of capex projects, which will increase its capacity and improve its production efficiency.

- Brownfield expansion at Mundra plant, Gujarat: PCBL is expanding its specialty chemical capacity at its Mundra plant by 20,000 MTPA. The first phase of this expansion was commissioned in July 2023.

- Greenfield project: PCBL has successfully commissioned the first phase (63,000 MTPA) and the final phase (84,000 MTPA) of its greenfield project in September 2023. This project has increased PCBL’s manufacturing capacity by 147,000 MTPA.

Once these projects are completed, PCBL’s total capacity will be 790,000 MT and its green power generation capacity will be 122 MW.

Read: CapEx vs OpEx

PCBL is targeting to add 80,000 to 100,000 tons of capacity every year in the coming years.

Overall, PCBL is well-positioned to benefit from the mid to long term opportunities in the global carbon black industry. The company is increasing its capacity and improving its production efficiency. As a result, PCBL is expected to see strong demand and margins in the coming years due to Reduction in India’s Carbon Black import & increase in India’s Carbon Black Export.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.