In the vast landscape of Indian business conglomerates, the Kirloskar Group has long been a prominent name. With a legacy spanning over a century, the group has made significant contributions to India’s industrial and engineering sectors. However, what truly sets the Kirloskar Group apart is a captivating story of a family dispute and the creation of multi-bagger stocks.

The Kirloskar Legacy

Founded in 1888 by Laxmanrao Kirloskar, the Kirloskar Group began its journey as a small bicycle repair shop in Belagavi, Karnataka. Over the decades, it expanded into a conglomerate with diverse interests in manufacturing, engineering, and infrastructure. The group’s success was rooted in its core values of integrity, quality, and innovation, which set the stage for its remarkable growth.

The Kirloskar Clan’s Internal Strife: Understanding the Family Dispute

- Accusations of Misusing Shareholder Resources

Rahul and Atul Kirloskar, executives of Kirloskar Pneumatic Company Limited (KPCL) and Kirloskar Oil Engines Limited (KOEL) respectively, accused Kirloskar Brothers Limited (KBL) of misusing shareholder resources and regulatory machinery after being cleared of insider trading charges by the Securities Appellate Tribunal (SAT). They questioned the Rs 274 crore expenditure on professional and legal expenses incurred since their dispute began in 2016.

- KBL Responds to Allegations of Misusing Funds

Kirloskar Brothers Limited (KBL) has vehemently denied allegations that it spent Rs 274 crore in personal disputes involving its Chairman and Managing Director, Sanjay Kirloskar, against his brothers, Rahul and Atul Kirloskar.

- KBL’s Defence

KBL refuted the allegations, clarifying that only approximately Rs 70 crore of the Rs 274 crore was related to legal expenses. The rest was spent on professional fees to improve the company’s business. The company justified these expenses given its consolidated annual turnover of over Rs 2,500 crore, emphasizing that it was logical. KBL also highlighted that its major shareholder, Kirloskar Industries Ltd (KIL), had not raised concerns in recent years, having supported accounts and dividends.

Since then, only the DFS agreement, which was inked in 2009, has been disclosed in the annual reports.

In Retrospect: Highlighting the Group’s Key Moments

In March 2023, the Kulkarni family’s substantial 18% share sale in Kirloskar Oil initially raised concerns. Surprisingly, the stock remained unwavering, buoyed by robust institutional demand.

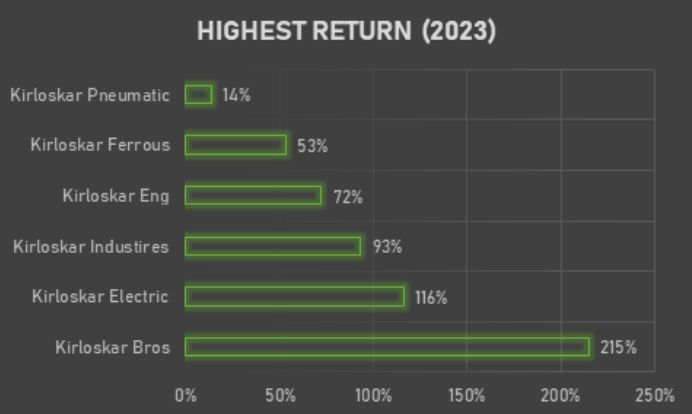

In 2022 when a family feud sent KBL’s stock winding. However, in 2023, KBL bounced back as a multi-bagger, delivering over 200% returns, and defying the earlier allegations. This incredible resurgence underscores the stock’s resilience and its remarkable journey from adversity to redemption in just one year.

Kirloskar Group Performance

Kirloskar Group Performance

Strategies for Success: Kirloskar Brothers’ Winning Formula

- Strong Free Cash Flow: Kirloskar Brothers maintains a robust free cash flow, providing ample resources to fuel expansion into new projects and ventures.

- Good ROI: Demonstrating success in new projects, Kirloskar Brothers delivers a high return on capital investments, generating new revenue streams and maximizing capital efficiency.

- Strong Brand Portfolio: Over the years, Kirloskar Brothers has strategically invested in building a formidable brand portfolio, a valuable asset when diversifying into new product categories.

- Outstanding Performance in New Markets: The company leverages its extensive experience to successfully enter and excel in new markets. This expansion strategy allows for the creation of fresh revenue streams and mitigates business cycle risks.

- Highly Skilled Labor: Kirloskar Brothers prides itself on a highly skilled workforce, nurtured through comprehensive training and development programs. This investment not only results in well-qualified employees but also motivates them to achieve excellence.

- Mergers and Acquisitions: The company boasts a track record of proficiently integrating acquired firms through mergers and acquisitions. By optimizing operations and establishing a stable supply chain, Kirloskar Brothers ensures the smooth assimilation of new entities.

In conclusion, Kirloskar Brothers is undeniably a brand that enjoys widespread customer trust and robust brand recognition, underpinned by a solid logistics network spanning all its markets. However, the company faces the growing challenge of heightened research and development efforts by an expanding roster of manufacturers and competitors within its industry.

Given its expansive presence across multiple countries, Kirloskar Brothers must maintain its commitment to innovation and product development. Leveraging its strengths, the company should continue to introduce new offerings to the market, complemented by the implementation of highly effective marketing strategies. In doing so, Kirloskar Brothers can safeguard and further its market position while proactively addressing the evolving competitive landscape.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.