In the world of financial markets, strategies and indicators play a crucial role in decision-making while trading in a stock. One such indicator, often cited in technical analysis, is the “Death Cross.” It sounds ominous, but understanding its implications and combining it with common strategies can be a valuable tool for investors. In this article, we’ll delve into what the Death Cross is and explore some common strategies associated with it.

What is the Death Cross?

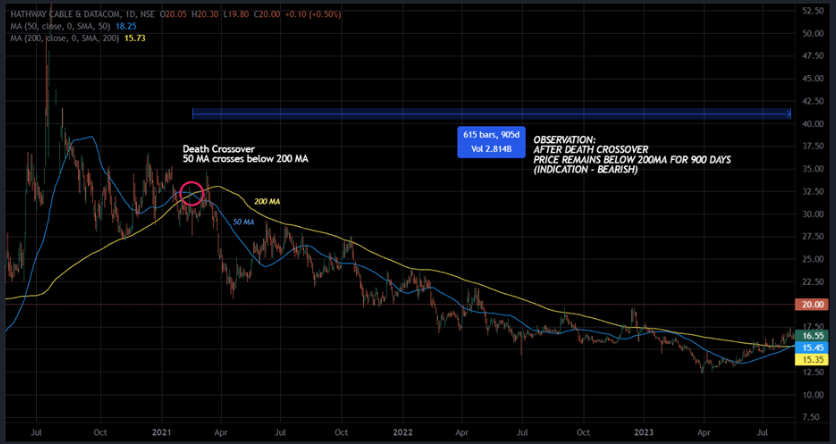

The Death Cross is a technical analysis term that describes a particular crossover of two moving averages. In most cases, it refers to the crossing of the 50-day moving average (short-term) below the 200-day moving average (long-term). This crossover suggests a potential shift in market sentiment from bullish to bearish.

Read: Golden Crossover Trading Strategies

Implications of the Death Cross:

- Bearish Sentiment

The Death Cross is seen as a bearish signal. It signifies that recent price trends (represented by the 50-day moving average) are weaker than longer-term trends (represented by the 200-day moving average), indicating a potential downtrend.

- Market Downturn

Historically, the Death Cross often precedes market downturns, though it doesn’t guarantee a bear market. It serves as a warning sign, prompting investors to exercise caution.

- Confirmation of Trends

The Death Cross can be a confirmation of an existing bearish trend or the beginning of a new one. Traders and investors use it to validate their suspicions of a weakening market.

[Death Crossover just prior to the pandemic]

The Death Cross primarily serves as an indicator that suggests a deterioration in price action over a slightly longer period, typically more than two months, when the crossing is executed by the 50-day moving average. It’s important to note that moving averages exclude weekends and market holidays when the market is closed.

From an intuitive standpoint, the Death Cross tends to offer a more meaningful signal for bearish market timing when it occurs after the market has already experienced losses of 20% or more. This is because, in such cases, the downward momentum is often indicative of deteriorating fundamentals. However, it’s essential to understand that its historical performance highlights the Death Cross as a lagging indicator of market weakness, meaning it aligns with the market’s weakening conditions rather than predicting them in advance.

Conclusion

The Death Cross is a technical indicator that serves as a warning sign of potential market weakness. However, it’s important to remember that no single indicator is foolproof, and its interpretation should be complemented by other market analyses and a thorough understanding of one’s investment goals and risk tolerance.