Introduction to becoming successful Trader

Flipping a coin – a simple act often used as a metaphor for the unpredictability of life’s choices. It’s a 50:50 chance of landing on heads or tails, right? But what if I told you that trading in the financial markets isn’t as random as a coin toss? In this intriguing exploration, we’re about to debunk a common misconception that equates trading success to flipping a coin.

The Misconception: A Trade Can Only Move Up or Down

The prevailing myth in trading circles suggests that a trade can only go one of two ways: up or down. Hence, the probability of predicting its direction correctly is assumed to be 50%, just like the probability of landing heads or tails when flipping a coin. However, this assumption oversimplifies market dynamics.

Debunking the Misconception

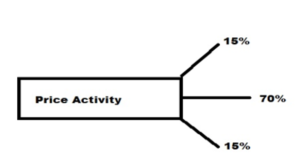

Imagine a stock that’s been moving sideways for an extended period, confined within a thick box on a chart. At first glance, it might seem that it has an equal chance of breaking up or down. But here’s where we apply a concept from Newtonian physics – an object in motion tends to stay in motion until acted upon by an opposing force.

In the context of trading, this opposing force could be a significant news event. This perspective changes the game. Instead of a 50:50 chance, we now have a 70% probability of the price continuing to move sideways and only 30% for alternative moves up or down. This 30% is then evenly split between upward and downward movement, resulting in 15% probabilities for each.

Trading in the direction of the sideways movement suddenly gives you an 85% chance of success (70% continuation + 15% upward movement). This means there’s an 85% probability of ending a trade with a price equal to or higher than your entry point.

Read: Guide to Building a Momentum Trading Portfolio

The Power of Trend Trading

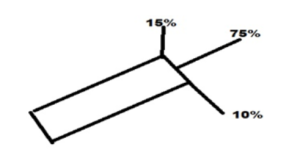

Now, let’s shift our focus to scenarios where the trend is evident. In an uptrend, it’s not a 50:50 proposition. Instead, there’s a 75% probability of the trend continuing. This acceleration of the trend also increases the likelihood of a price surge above the trend line.

Learn: Trendline Trading Top Secrets

Unlike sideways movement, the probability of an upward move isn’t 50%. It remains at 15%. However, the probability of a trend reversal (a drop in prices) drops to 10%. This translates to a staggering 90% probability of the trend continuing (75% continuation + 15% upward movement).

This is the raw power of trend trading. Selecting stocks with such a high probability of an uptrend continuation significantly boosts your odds of success.

The Downside of Downtrends

In the case of downtrends, the dynamics change once again. Downtrends tend to be swift and forceful. Here, an 80% probability exists of the trend continuing, while around 15% represents the chance of a rapid price decline due to panic selling. Combined, this results in a staggering 95% probability of the downtrend continuing.

Only a meager 5% probability remains for a trend reversal into an uptrend. This stark contrast between continuation and reversal is crucial to understand.

Conclusion: Trading Is Not a Coin Toss

In the world of trading, knowing the balance of probabilities inherent in market behavior dispels the notion that success is akin to flipping a coin. Decisions in trading aren’t random; they’re informed by data, analysis, and an understanding of market dynamics.

So, as you ponder the decisions you make daily, remember that not all decisions are created equal. When it comes to trading, knowledge, strategy, and an awareness of probabilities are your allies on the path to success. Trading is not a game of chance; it’s a calculated endeavor where the odds can be tilted in your favor.