Freak trades are unique occurrences in the fast-paced world of finance that deviate from the regular flow of trade activity. These events, which are frequently marked by abrupt and sharp price swings, can be confusing for investors and give rise to worries about the stability of the market.

Comprehending the origins and ramifications of freak trades is essential for skilfully managing the financial terrain.

What are Freak Trades?

Trades that execute at prices substantially different from the going rate in the market are referred to as freak trades, mistaken trades, or fat finger trades. Usually, technological malfunctions, human error, or deceptive tactics result in these trades.

There has been an increase in what has been called “freak trades” in the futures and options (F&O) segment of the Indian markets in the year 2021. Participants reported that trades in F&O contracts have been executed at a price that is significantly different from the current market price.

A recent example of freak trade was on Friday, September 8, 2023, the day of expiry, Dalal Street witnessed a great deal of drama. The Sensex Call Options with 67,000 strike saw a bizarre trade that may have been caused by a trader entering an incorrect order. This trade caused the option to jump by almost 5,000% in a matter of seconds, from Rs 4.30 to Rs 209.25.

It is very important to safeguard yourself to avoid losses. Beware of Forgotten Pending Orders, imagine you sold an option for Rs 100 and placed a stop-loss order around Rs 150 to protect yourself from potential losses. Your option’s value plummets to Rs 1, and you happily exit the trade, forgetting about your pending SL order.

Later, you discover that your pending BUY order was executed at around Rs 150, only for the option’s value to immediately drop back to Rs 1 or Rs 2. This scenario occurs because many traders neglect to cancel pending orders placed at various price levels.

High-frequency traders and price manipulators take advantage of these numerous uncancelled pending orders, as was the case in SENSEX freak trades.

At approximately 3:28 PM, a Rs 0.1 option soared to Rs 75 before crashing back to Rs 0.1 in less than a minute. Numerous trades incurred substantial losses as a result of this manipulation.

To avoid such pitfalls, always remember to cancel your pending orders promptly.

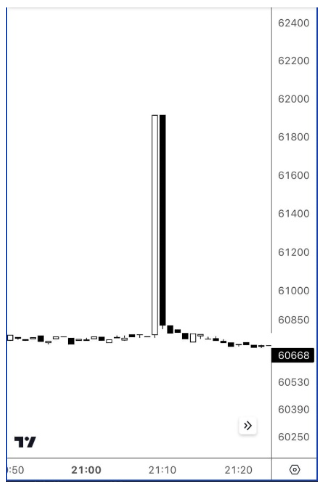

How Freak Trade looks on the chart,

This trade is spotted on Gold Futures 1-minute chart

This trade is spotted on Gold Futures 1-minute chart

What Causes the Freak Trade?

- Human error: Even small errors, like inputting the incorrect order quantity or price, can have a big impact on price variations.

- Technical glitches: Mistakes in software or communication can result in trades being executed incorrectly.

- Manipulative Attempts: People or organizations may carry out freak trades on purpose in an effort to influence market values or generate trading opportunities.

Effect of Freak Trade

- Price Volatility: Abrupt and unforeseen price fluctuations brought on by odd trades may cause the market to momentarily descend into chaos and uncertainty.

- Investor Losses: Traders may sustain large financial losses if they execute or hold positions impacted by freak trades.

- Regulatory Scrutiny: In order to strengthen market safeguards and identify possible underlying issues, regulators frequently look into freak trades.

How to avoid Freak Trade Trap?

- Utilise Limit Orders: Limit orders specify a maximum price at which an order can be executed, preventing trades from executing at unintended levels.

- Monitor Market Activity: Stay informed about market news and events to identify potential freak trades in progress.

- Diversify Investments: Spread investments across different asset classes to minimize losses from freak trades targeting specific securities.

- Choose Reputable Brokers: Trade with reputable brokers known for robust trading systems and rigorous testing procedures.

- Support Regulatory Oversight: Back regulatory efforts to strengthen trading rules and enhance market supervision to deter manipulative attempts.